Want to find a fast-growing company trading at a good valuation in this overheated market?

Here is one that is growing its revenues at more than 100% but is trading at a 30% discount.

It’s rare to find a company growing at more than 100% but is trading significantly below its fair value. This company is not going to grow at 100% forever, but even if you were to halve its growth, the financials and fundamentals of the business still look attractive. This company is none other than coinbase (NASDAQ: COIN).

Brief History of Coinbase

Coinbase was founded in July 2011 by former Airbnb engineer Brian Armstrong. The company made history in April 2021 by being the first crypto company in the world to go public. Coinbase listed on Nasdaq, and its direct listing opened at $350 per share.

What is Coinbase and What Does it Do?

Coinbase is a safe and easy-to-use platform to buy, sell, store, save, spend, and use cryptocurrency. It builds the infrastructure to power the cryptoeconomy 1, helping bring the benefits of this new technology to the world.

(1) Cryptoeconomy: A new open financial system built upon crypto.

Coinbase CEO Brian Armstrong holds a long-term view for the company, something which I appreciate as a shareholder:

You can expect volatility in our financials, given the price cycles of the cryptocurrency industry. This doesn’t faze us because we’ve always taken a long-term perspective on crypto adoption. We may earn a profit when revenues are high, and we may lose money when revenues are low, but our goal is to roughly operate the company at break even, smoothed out over time, for the time being. We are looking for long-term investors who believe in our mission and will hold through price cycles.

Coinbase’s products can be divided into 3 lines of business:

For Individuals: Coinbase, Wallet, USD coin

Coinbase and Coinbase Pro

Screenshot of Coinbase’s Exchange, GDAX

Coinbase operates both an order book exchange, called the Global Digital Asset Exchange (GDAX), and a brokerage, called Coinbase.

Retail investors can buy and sell directly from Coinbase’s brokerage, like they might buy a stock from any other brokerage. Coinbase’s brokerage fees range from roughly 1.5% to 4.0% depending on the user’s payment method. Payment by credit cards typically incur higher fees than bank transfers.

Screenshot of Coinbase’s Brokerage

Wallet

Coinbase Wallet is a self-hosted software wallet product. This wallet enables users to participate in the cryptoeconomy — without intermediaries — including access to DeFi apps, NFT marketplaces, and sending and receiving crypto.

USD Coin

USD Coin (USDC) is a cryptocurrency that known as a stablecoin. We can always redeem 1 USD Coin for US$1.00, giving it a stable price.

For businesses: Prime, Commerce

Prime

Coinbase Prime is a best in class offering that combines advanced trading, trusted custody, analytics, and financing in a single solution and gives institutions access to the robust tools and services they need to invest in crypto.

Commerce

Businesses can use the Coinbase Commerce platform to accept crypto payments. Businesses that run their shops on major eCommerce platforms can integrate Coinbase Commerce into their checkout process. Coinbase offers integration with 12 eCommerce services, including Shopify and Magento.

For developers: Cloud, Connect

Cloud

Coinbase Cloud enables developers to build and integrate with crypto products more efficiently and effectively.

Connect

Connect is an API that teams can use to connect their apps to more than 60M Coinbase customers.

The Problem Coinbase Aims to Solve in Crypto

Cryptocurrency is still too difficult to use for the average person. In the same way that people can access the internet without understanding how TCP/IP works or turn on a light switch without understanding how electricity works, they need to be able to use cryptocurrency without understanding the underlying complexity.

How Does Coinbase Make Money?

Transaction revenue -> represented over 96% of net revenue (increase 137% yoy)

Subscription products and services -> not significant revenue contributor but growing at 126% from 2019 to 2020. Company committed to growing this portion (increase 126% yoy)

Other revenue (increase 168% yoy)

My Investment Thesis:

Market leading brand exclusively focused on the crypto economy

First mover advantage being the first listed crypto exchange

Trusted platform owing to heritage of security and culture of regulatory compliance

Growing adoption of crypto assets (150% CAGR over the last 8 years)

Covid 19 has no impact on company’s operating results, if anything Covid might accelerate its growth

Secure in-house source of liquidity (Coinbase buys crypto assets from Global Digital Asset Exchange (GDAX) instead of from an outside exchange)

What Could Go Wrong?

Demand for BTC and ETH declines, leading to decline in transaction volume (about 50% of company’s net revenue is derived from BTC and ETH)

Cyberattacks and security breaches on platform

Competition against other crypto platforms

Valuation

For companies like Coinbase whose operating cash flow is positive, I like to use a 10-year discounted cash flow model to evaluate the company.

Performing a DCF calculation using:

Operating cash flow = $3,004 million

Total Debt = $874 million

Cash and Short Term Investments = $1,061 million

Number of shares outstanding (diluted) = 206 million

Assumptions:

Cash flow growth rate for Year 1 to 5 = 40%

Cash flow growth rate for Year 6 to 10 =15%

Discount rate = 10%

As with any discounted cash flow projection, there are some assumptions that has to be made. Careful consideration has to be made to ensure that these assumptions are reasonable

Using a discount rate of 10%, the intrinsic value of Coinbase (COIN) is about $438. I like to give a margin of error of 20% in case I am wrong in my calculation. Anything below $350 (20% less than estimated intrinsic value) is a good price for me.

Intrinsic value is a fluid number. The valuation of a company is a range rather than an exact number. For a company that is growing at more than 100%, using an operating cash flow growth rate of 40% for the first 5 years and 15% thereafter for the next 5 years is quite conservative. Despite this, we are still seeing that the company is trading at 30% below its intrinsic value. At this price, it is almost a no-brainer.

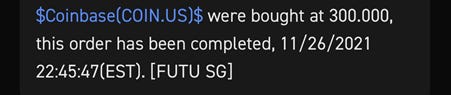

Here’s my Black Friday COIN purchase to prove that I walk the talk.

Conclusion

I expect the cryptocurrency asset class to grow exponentially in the coming years and decades.

Bitcoin has been around for more than 10 years and its likely to be around for the foreseeable future. Likewise, Ethereum has been around for more than 5 years. It’s being used in NFTs and play-to-earn games like Axie infinity.

If you believe that Bitcoin and Ethereum will continue to grow and gain adoption in future, Coinbase is likely to be the biggest beneficiary. It’s not like there are any other crypto exchanges that are listed at this moment of time anyway.

P.S If you enjoyed this, please help to spread the word by sharing with your family and friends.