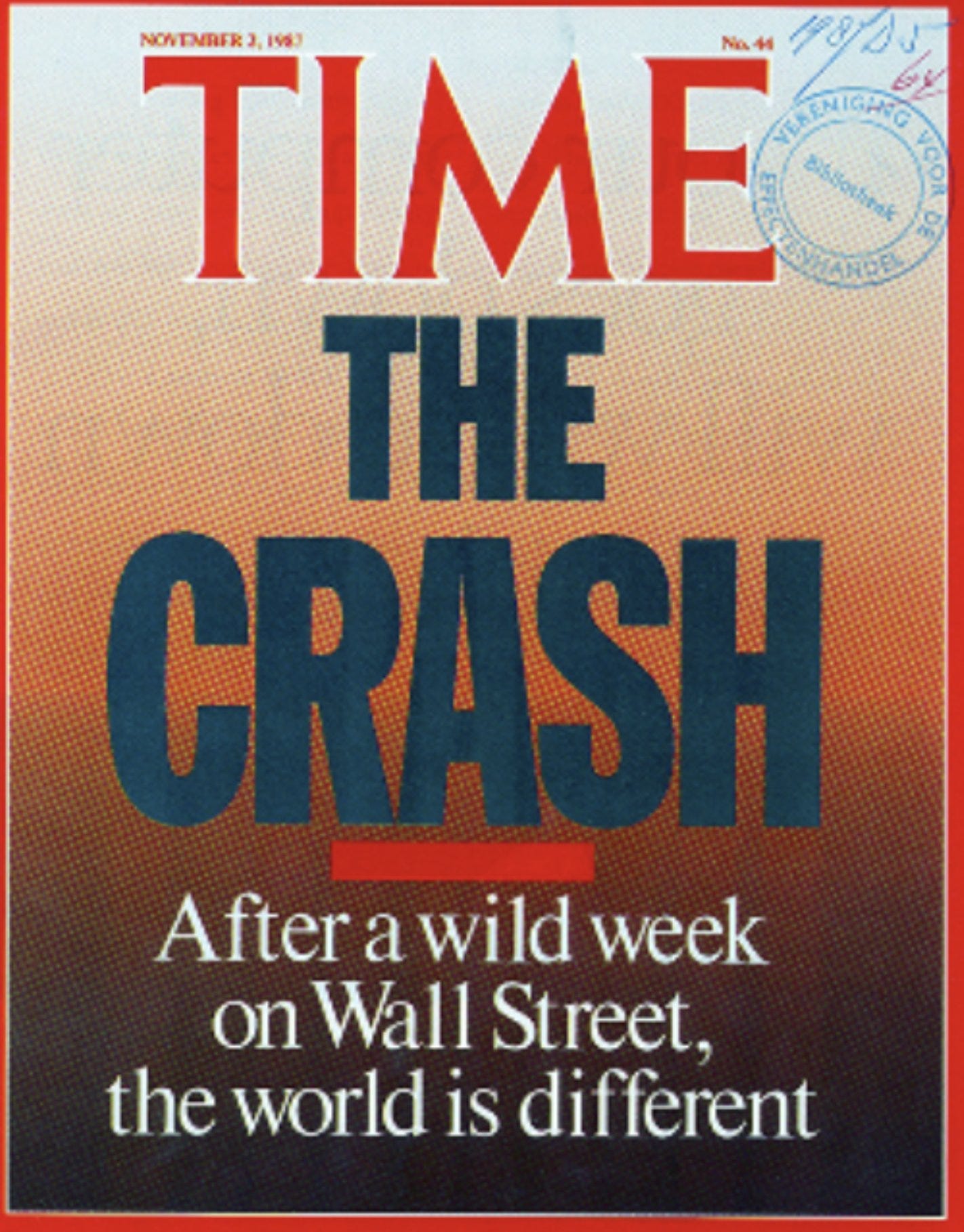

Market crashes can be terrifying. Sometimes, it may seem like it’s the end of the world and there’s no recovering from it. Scary media headlines only compound matters.

With these 7 ways, you’ll be able to navigate the next crash better.

1) Understand The Stocks You Own, and Why You Own Them

Have an investment thesis. This should be the number ONE thing you do BEFORE investing into any company.

An investment thesis should include:

Your reason for buying the company

What can go wrong?

Valuation

If you have not done proper research before buying, it is likely that you will end up panicking when the share price falls. Do yourself a favour by putting in the time and effort.

Having a solid investment thesis prevents you from selling out perfectly good long-term investments during a market downturn.

If you’re unsure on how to research a company, you may use mine as a guide here.

2) Portfolio Rebalancing

A market crash is a good time to review and rebalance our investment portfolio. Selling some stocks and buying into others which present better opportunities.

I did a thread on Twitter summarising Tom Nash’s video on “How to Build a Bulletproof Portfolio for 2021” here. The investing principles he shared are timeless and can still be applied going into 2022 and beyond.

With a bulletproof portfolio, you’re likely to handle market crashes better.

3) Have Spare Cash Of At Least 10 To 15%

You’ve heard of the term “Cash is trash”. But without cash, you will not be able to capitalise on market crashes to buy on dips.

Having cash allows us to buy on dips. The greatest opportunity lies when there is the most fear and blood on the streets.

As Warren Buffett famously said:

Buy when the market is fearful, sell when the market is greedy.

Morgan Housel, author of “The Psychology of Money” came up with a plan on how to invest your spare cash.

It works the same whether you have $1,000, $10,000, $100,000, or $1,000,000. Just adjust the figures accordingly.

4) Time The Market (YES you read that right!)

Whilst I’m no market timer, there’s an indicator that gives us an estimate as to when the market could be bottoming. That is the fear and greed index.

The fear and greed index gives us a sense of how fearful or greedy the market is. The readings range from 0 to 100. The lower the reading, the more fearful Mr Market is and vice versa. We want to buy when the reading is low, a time when there is the most fear.

As seen from the chart, the only times the reading goes below 20 was during the Covid crash in March 2020 and the crash in Dec 2018. Once the reading hits 20, chances are the market is nearing its bottom and is likely to rebound. It’s high probability and not a 100% guarantee.

Some stocks may fall more than others. Stock selection is the most important.

Which brings us to our next point.

5) Buy ETFs

The market is crashing! You have spare cash but don’t know which stock to buy.

Here’s the solution: Buy an ETF.

This is a GUARANTEED to make money over the long run. By long run, I mean years and decades, not 1 month or even 1 year.

Why does this work? Due to the existence of inflation. Inflation causes prices of items to increase. Companies selling the items increase their prices, generating greater profits. As companies generate more profits, the share prices of the companies rise.

$SPY and $VTI are 2 of my favourites:

$SPY was listed in Feb 1993 at a share price of $44.41. Today, its share price is more than $400. That’s a return of more than 900% over 28 years.

$VTI was listed in Jul 2001 at a share price of $55.42. Today, its share price is over $200. That’s a return of more than 300% over 20 years.

6) Deep Breathing

I’m no science expert, but deep breathing is one way to calm your nerves. During market crashes, it is easy to panic and start becoming fearful. Practising deep breathing can calm our nerves and help us navigate through the market volatility.

Breathing is the easiest and most instrumental part of the autonomic nervous system to control and navigate. The way you breathe strongly affects the chemical and physiological activities in your body.

Here’s a breathing method called Wim Hof Method. Invented by a guy named Wim Hof, the breathing technique is premised on inhaling deeply and exhaling without any use of force. Throughout the years, Wim Hof has developed special breathing exertions that keep his body in optimal condition and in complete control even in the most extreme conditions.

Try out the guided breathing exercise here!

7) Think Long-Term

Take a long-term perspective on your investments.

Zoom out the chart over 1 year, 5 years, 10 years. You’re likely to see a good clear uptrend for the stocks you’re holding. If not, you’re probably invested in the wrong company.

Let’s take an example of Google.

The company’s share price has declined 10% or more a total of 28 times since IPO in 2004.

Total returns since IPO is > 5,000%.

The short-term declines are hardly visible on the chart.

Short term declines of good companies represent good buying opportunities. Don’t allow the opportunity to go to waste.

Final Thoughts

The next time there is a market crash, look back at these 7 steps. See which one resonates most with you and implement them. Knowledge is useless without implementation.

P.S If you enjoyed this, please help to spread the word by sharing with your family and friends.