With Berkshire Hathaway’s recent AGM fresh in investors’ mind, it’s no surprise to see many investors getting a piece of the company shares.

The record cash pile of $189bn must’ve been too good to ignore.

At a time like this, buying shares of a company run by Warren Buffett sounds like a bright idea.

Selling them may sound stupid.

But that’s exactly what I’m doing.

3 weeks after buying up shares of the company, I am now selling out.

Before you curse and swear at me for being fickle, hear me out.

There’s a reason to the “madness”.

1. Valuation

No matter how good we think a business may be, the price we pay matters.

It’s no longer a good investment if we pay too high a price, even for a high quality business like Berkshire Hathaway.

I primarily use a discounted cash flow (DCF) model to value businesses, where a slight tweak to growth rates can drastically change the company’s intrinsic value.

Where I previously used a 15% growth rate to project cash flows for the first 5 years, the company’s revenue has grown at 8% CAGR over the last 5 years.

Operating cash flow has grown at a CAGR of only 5% over the last 10 years.

Using a 15% growth rate in my calculation felt overly optimistic.

I was wrong, and I am happy to admit it by selling.

2. Investment Goals

The stock price of the company tends to converge with the company’s growth rate over time.

Berkshire is growing at 5 to 10% per year, hence I expect the stock price growth to be similar.

This is not aligned with my investment goal of generating 15% to 20% CAGR per year for my U.S stock portfolio.

We can be buying the greatest stock in the world, but if it doesn’t align with our investment goals, then it won’t work.

Investment suitability is a topic that should be, but is not often talked about.

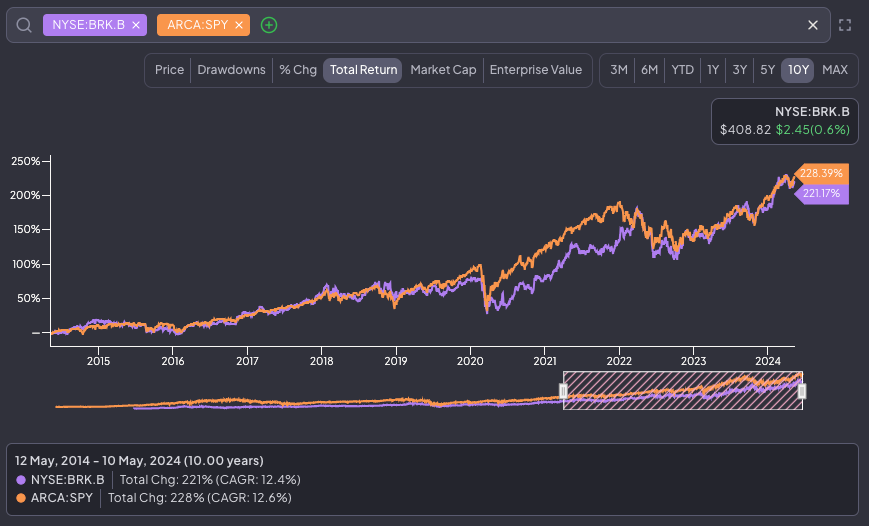

3. Lacklustre Share Price Performance

A decade is a long time, especially in the investment world, where 1 week feels like a lifetime.

Holding a stock for 10 years and still slightly lag the S&P500 can be demoralising.

With the difference in returns being minimal, we’d be better off just sticking to the index and saving all the headache that comes with stock picking.

From a risk-to-reward perspective, it’s better off holding the S&P500 (unless Berkshire gets severely undervalued).

4. Alternative Investment Opportunities

Arguably the main reason why I sold my Berkshire shares - to capitalise on other investment opportunities which I spotted in the market.

As the saying goes:

“There’s only one reason why investors may buy a stock, but there are many as to why they may sell.”

Selling a stock is not a diss on that company.

I only sold because I found a more compelling opportunity, a better alternative to deploy my capital.

A company with a recurring subscription revenue.

One that is growing its cash flow consistently year-after-year over the last decade.

Conclusion

All this is not to say that Berkshire Hathaway is not a good company.

It still is.

The business fundamentals of the company remain sound.

I’m sure the company will do well in the foreseeable future, be it under the leadership of Warren Buffett or Greg Abel.

The only problem this time is: The price is not right.

P.S If you’re curious to know what stock I bought, it will be revealed in my next article.