Sale again?

How often does your favourite item go on sale?

Maybe it’s on a monthly basis, like Shopee’s 01/01, 02/02, or 03/03.

Maybe it’s once or twice a year, like Black Friday/ Cyber Monday.

What’s for sure is that you seldom encounter an item that goes on sale for weeks.

That’s exactly what we’re seeing in the stock market.

It’s why I just bought some shares during the Friday selloff.

If we’ve been following me, it’s not hard to guess what stock I bought.

After all, this is a company that’s been talked about to death, both by me and others alike.

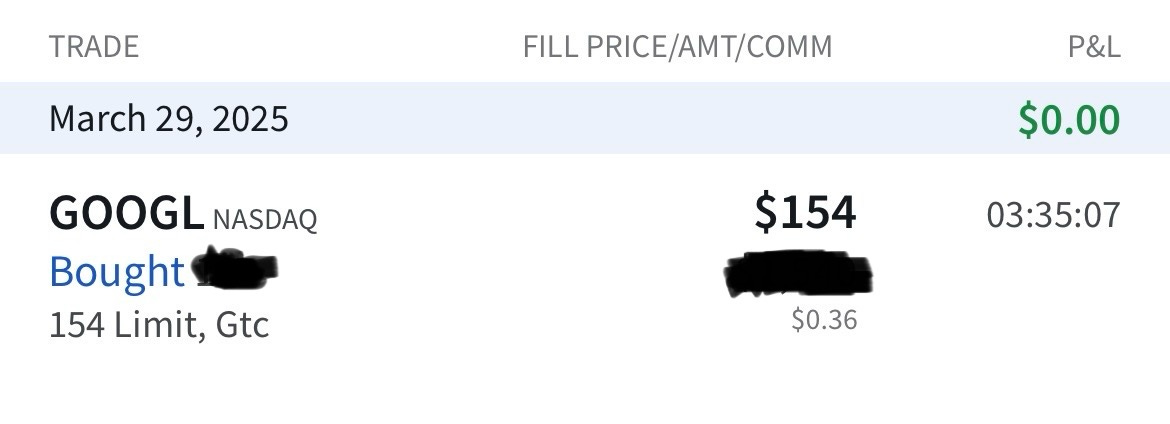

Yes, I just added to my position in GOOGL, after the market hit my GTC limit order of $154.

My strategy is simple in theory, but difficult in execution.

Here’s what it looks like:

Place a GTC limit order at a price level below my intrinsic value

Wait till the price falls below the value and forget about it.

It may take weeks, months, or even years for the order to be filled.

That doesn’t matter.

And no I didn’t have to manually click the buy button.

No need to burn the midnight oil to watch the charts, waiting for GOOGL to drop to $154.

My order was filled at 3.35am, a time when I was in la-la land.

An undervalued gem

In the midst of this selloff, there’s one company that has come to my attention. A company that I don’t many talking about.

That company is Adobe.

Just like a certain Microsoft (which is still overvalued imo), this one has always been on my radar, but it always seems to be over-valued.

Now that it’s come down significantly, it’s time to take a closer look.

At its current price of $385, the stock is trading at a discount of 29%.

“Everyone likes discounts, right?”

“Wrong”

Why else do we see so many panic selling during market crashes?

The problem is: When a stock trades at a discount, there is some bad news surrounding either the company, or the macro-environment.

In Adobe’s case, it is the uncertainty around its AI exploits. The future profitability of Adobe's AI efforts remains a significant unknown.

The stock market has punished its stock price based on this unknown.

As a company operating on a subscription based model, the majority of the company’s revenue are recurring.

More on the company in my next article.

Stay tuned.