The Exact 5-Step Checklist I Use To Conduct Due Diligence for Any Stock

Have you ever been told by a “guru” or “expert” to “Do your own due diligence (DYODD)”? You must’ve gone back thinking: “What does that even mean? How do I even start?”

Fret not, because this is where you’ll learn how to. It doesn’t have to be complicated. I’ll be using Coinbase (COIN) as a case study.

My 5-Step DYODD Process

1. What’s the company name, ticker symbol, and current market cap?

Company name: Coinbase

Ticker symbol: COIN

Current market cap: $49 billion

2. How does the company make money?

This is a SUPER important but often overlooked metric. Cash is the lifeblood of a business.

Transaction revenue makes up a total of 93% of the company’s net revenue. This consists of buying and selling cryptocurrencies. 88.3% of this comes from retail investors, while the remaining 4.7% comes from institutions.

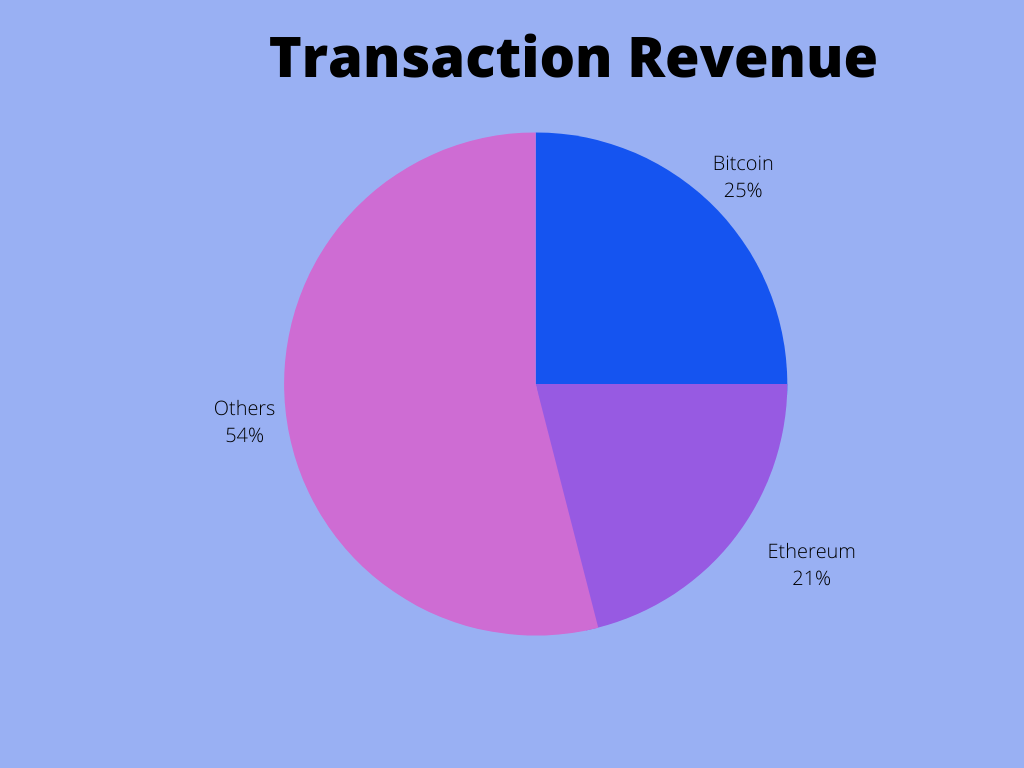

Which are the most popular cryptos that are being transacted?

Of the transaction revenue in 2021, Bitcoin makes up 25% and Ethereum makes up 21%. In total, these 2 cryptos make up almost 50% of total transaction revenue.

3. Present 3 to 5 Thesis Points

These can cover aspects of the business that are underappreciated by the market. Any "variant" perception that matters for the stock should be included in these thesis points.

4. Risks or Pre-Mortem on What Can Go Wrong

5. Valuation

You don’t need to be a math expert to do basic valuation. Some rough math on how you're valuing the company will do. It’s important to choose a valuation method that works, and one that you’re comfortable with.

Personally, I use a 10 year discounted cash flow. The drawback is that this does not work for loss making companies.

If you’d like a copy of my valuation template, you may access it here.

Conclusion

Do you now have a clearer idea on how to do your own due diligence? The next time someone tells you this, you’ll have a structured framework to follow.