Ah, another stock market sale!

But just like any sale, don't buy just because it's cheap.

Ask yourself: Is it a good investment, and do I really need it?

You wouldn't buy a sixth pair of shoes, right?

Similarly, don't overload on one stock.

Think about portfolio sizing.

If you've got a $100k investment portfolio and $30k is already in Amazon stock, maybe skip the discount.

Despite the company’s strength, excessive concentration in a single stock poses a significant risk.

A sudden 50% decline can lead to a significant capital drawdown in our portfolios, which can be emotionally challenging.

Salesforce (CRM)

This well-known company, particularly familiar to working professionals, excels at creating a sticky ecosystem.

Switching away from their offerings is incredibly difficult.

For example, my employer uses Salesforce as our CRM. The prospect of retraining our relationship managers on a new system and migrating all our data is daunting.

We're far more likely to stay within the familiar Salesforce environment.

Amazon (AMZN)

This was one of my earliest U.S. stock picks, and it's been a great performer.

I love the diverse business – e-commerce, cloud, ads, subscriptions – they've got it all.

The online store segment is solid, but AWS is the real powerhouse with its amazing growth.

It’s only now that I finally got the chance to add more shares.

Alphabet (GOOGL)

You know this one – the biggest name in online advertising.

I've talked about it a lot, and for good reason.

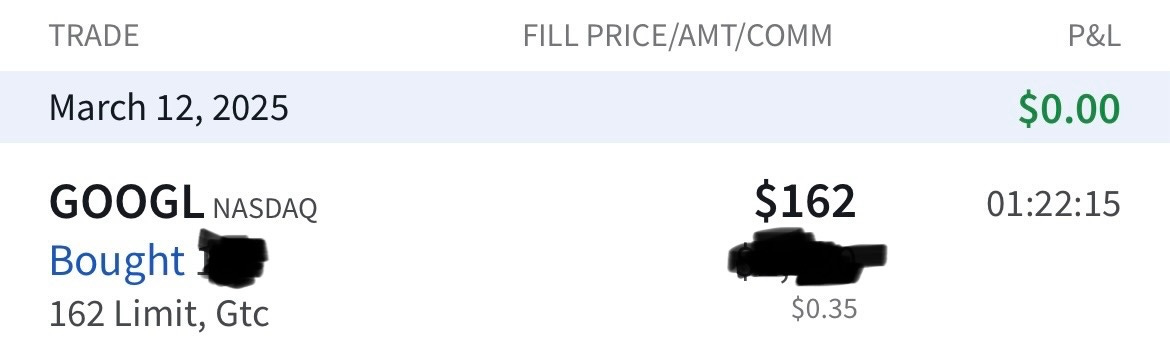

I’ve been building my position in GOOGL, buying in March 2024 at $138, September 2024 at $149, and this time, I’ve added more at $162.

My September 2024 calculation showed an intrinsic value of $198, which has now risen to $220.

This illustrates a key principle: the intrinsic value of strong companies tends to grow, making averaging up a viable strategy.

How to know what to buy

Market corrections create buying opportunities, but with limited funds, prioritisation is key.

Here's my two-step strategy:

First, focus on your existing portfolio's top performers. These proven winners have a higher likelihood of rebounding.

Second, from this select group, identify the most undervalued stock by comparing its current price to its intrinsic value. Buying significantly below intrinsic value increases the probability of profitable returns.

While the market offers a wide array of choices, these three stand out as my favourites.