The best high interest savings account for 9–5 employees in SG

Which of the big 3 banks has the best rate?

Getting 0.05% interest on your cash savings no longer cuts it.

Maybe it used to when interest rates were low, but not anymore.

Inflation is rearing its ugly head.

Price of literally everything are shooting through the roof.

Investing in the stock market may seem like the solution, until you realise that you’ve run out of cash to pay your bills.

Luckily, if you’re a 9–5 employee in Singapore, there’s good news.

You can get up to 5% on your cash savings.

Yes, you read that right.

You can get up to 5% interest just by leaving your cash in the bank.

There’re criteria that you’ll need to meet, but they’re not hard to do.

So, which of the 3 big banks offer the most attractive rates now?

UOB Bank

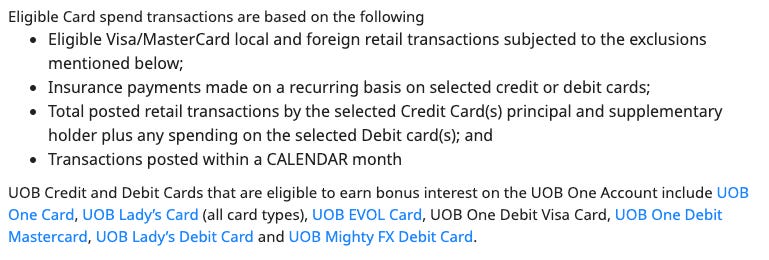

If you consistently spend at least $500 per month on eligible card transactions, and credit a monthly salary of at least $1,600, the UOB One account is a no brainer.

3.85% interest is the minimum you’ll be getting.

DBS Bank

The DBS multiplier savings account used to be the go-to option for me.

Over time, its appeal has started to wane.

While there’s no minimum amount of salary credit required, the higher the amount the more interest you’ll get.

Salary credit contributes to the total eligible transactions per month, which helps move you to a higher interest tier.

That being said, salary credit is just 1 requirement.

Credit card spend is another criteria you can use. The good thing is that there’s no required amount to hit to earn the bonus interest.

With salary credit plus transactions in 1 category (e.g. credit card spend), you’ll only be getting 2.2% interest at the highest tier (which kinda sucks tbh).

Realistically, most of us are only able to get 1.5% to 2.5% of interest, unless you’re a high income earner or receive a substantial amount of dividends from your investments.

OCBC Bank

OCBC’s flagship high interest savings account is the OCBC 360.

If you’re a 9-to-5 employee, there should be no problem hitting 2% when you credit your salary of at least $1,800 to the account.

It’s the part after this that becomes tricky.

If you’re able to increase your average daily balance by at least $500 monthly, you get an additional 1.2%.

That gives us an interest of 3.2% for the first $75,000 of funds.

The problem with this is that you might have some short term emergencies which require cash outlay.

This will mean that you can’t meet the second criteria of increasing your average daily balance by at least $500 monthly.

There’s another way.

If you charge at least $500 to an OCBC credit card, you get additional 0.60% interest.

Realistically, you’ll get between 2% to 3.2% of interest for the first $75,000 of funds.

Which am I using?

Out of the three, the UOB One account is my preferred choice

It’s simple and fuss-free.

Salary credit + $500 spend on an eligible UOB credit card is all you need to get 3.85%.

It’s the one that gives me the most rewards with the least effort.