The best risk-free account yielding more than 3%

No salary credit, no credit card spend, no problem

Finding a risk-free investment can be difficult.

But it doesn’t need to be.

With the rise of digital banks in Singapore, more people are coming round to the idea of using them to park their emergency funds.

And with good reason.

Not only do they offer higher interest rates than our traditional banks, they have less (or no) criteria to fulfil to enjoy those rates.

GXS — the digital bank of choice?

If you follow me on social media, you’d know that I am a huge fan and user of GXS Bank.

GXS Bank is a digital bank formed by a joint venture between Grab and Singtel.

There’re 2 parts to this account:

Main account — 0.08% p.a

Savings Pocket — 3.48%

The eye-catching part is the 3.48% interest that GXS offers on amounts in the savings pocket.

A savings pocket is meant to help you save towards a specific big ticket item such as a wedding, holiday etc.

Even if you don’t have a specific item to save for, just make one up and you’re good to go.

The main account only gives interest of 0.08%, so do transfer everything to the savings account to enjoy 3.48% interest.

Each account has a maximum deposit cap of S$75,000. This is fully insured by SDIC.

Pros

For me, the pros far outweigh the cons in this one.

1. Simple and low maintenance

The biggest reason why I like this so much is because of its simplicity.

No minimum balance or deposit

No lock-in period

No other criteria

Unlike a traditional bank, there are no criteria to enjoy higher interest (like crediting salary or spending on credit card).

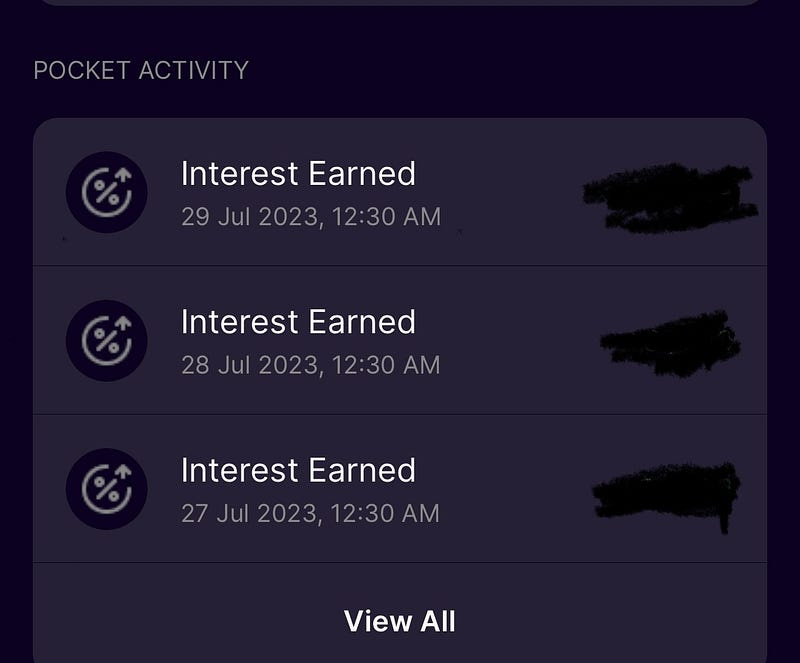

2. Daily Payouts

Another feature of GXS is its daily payouts.

Seeing money (i.e. interest) credited into your account on a daily basis must excite some of you, right?

As gimmicky as it may be, effectively your interest is more than 3.48% when taking this into consideration.

3. Fully insured with SDIC

A big plus point is that you don’t have to worry about GXS going bust.

Because it’s fully insured by SDIC for deposits up to $75,000 (just like our normal banks), you know your monies are safe with them.

Cons

It’s not all rainbows and butterflies with GXS.

There are some downsides with GXS.

Although these don’t affect me, they are still worth mentioning for those looking to open an account.

1. Waiting time

At the moment, all GXS savings account slots are full.

You may need to wait if you want to open an account.

I suspect that this may be due to the $50 million deposit cap imposed on new digital banks.

Whether this cap will be raised remains to be seen.

2. No branches or ATMs

Unlike traditional banks, there are no physical branches or ATMs.

With the rise of cashless payments, this is not a big issue for most people.

After all, when was the last time you made a cash withdrawal from an ATM?

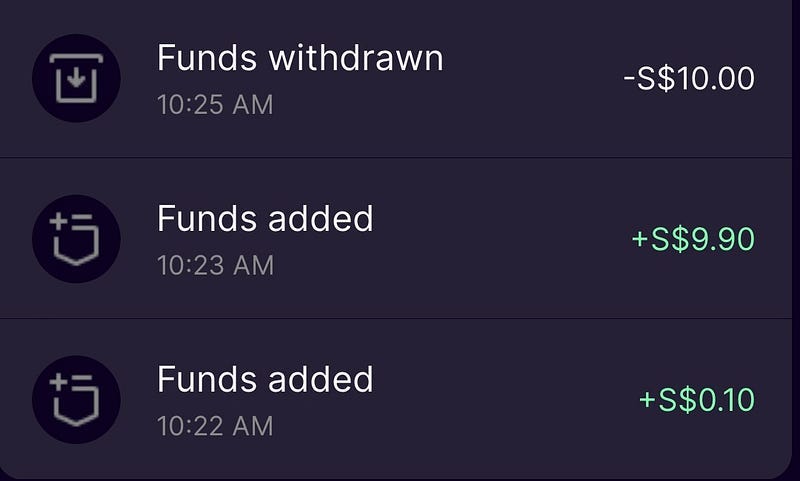

How fast are fund transfers?

As an added measure, I tested how fast it took to deposit and withdraw funds.

Turns out, both deposits and withdrawals were almost instantaneous.

This gives me further re-assurance that my funds are highly liquid.

Should I need to use cash urgently, this is a reliable source I can tap on.

Conclusion

Overall, I feel this is a good account especially for those who cannot meet the hurdles set by banks like salary credit and credit card spend.

It’s also worth noting the interest rate of 3.48% that GXS provides may be subject to change in the future.

Enjoy it while it lasts.