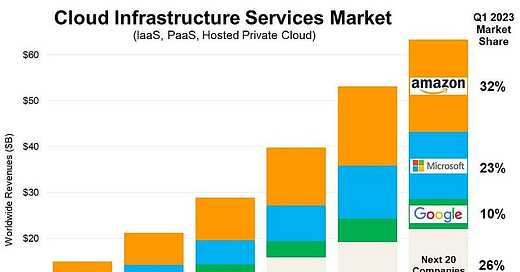

The Cloud Infrastructure Services Market enjoyed a $64 billion spending in Q1 2023.

This represents an increase of 20% year-on-year and 4% quarter-on-quarter.

Coincidentally (or not), the top 3 companies in this space (Microsoft, and Google, and Amazon) just reported earnings.

Let’s dig in to explore how they fared, and who has the upper hand.

MSFT: Frontrunner in the AI space?

Revenues +7%

Operating income +10%

EPS +9%

Good

✅ Announced new multi-billion dollar investment in OpenAI

✅ Teams communication app had more than 300 million users

✅ Growth in revenue per user → 14% more revenue from commercial Office 365 productivity software subscriptions.

Ugly

❌ Windows OEM revenue decreased 28%

❌ PC shipments declined 30%

Summary

Revenue from its crown jewel (Azure & other cloud services) grew by 27%.

Management is heavily focused on innovation with the help of AI, to help consumers get the most value out of their digital spend.

Early signs look promising after their huge investment in OpenAI, to leverage on the power of AI.

Google — Search Leader, Cloud Lagger?

Revenues +5%

Operating income -13%

Operating margin -5%

Net income -8%

Diluted EPS -5%

Good

✅ EPS & revenue beat expectations

✅ Share buyback of $70B

✅ Turned a profit in its cloud-computing business

Ugly

❌ To reduce costs, the company plans to layoff 12,000 employees, 6% of its workforce.

❌ Google’s AI chatbot, Bard, is feeling pressure from the popularity of ChatGPT.

❌ Youtube is facing heightened competition from Tiktok in short-form videos.

Summary

✳️ While advertisers have been cutting their ad spend, Google still holds more than 90% market share in search.

✳️ The company remains the market leader in the search engine market, which bodes well for the company’s ad revenue.

✳️ This is possibly a short-term issue that will revert to the mean once the macro environment takes a turn for the better.

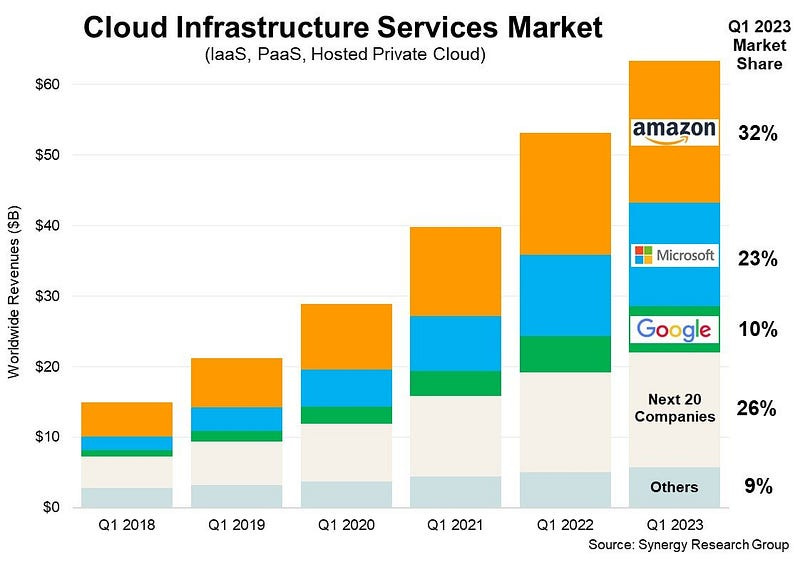

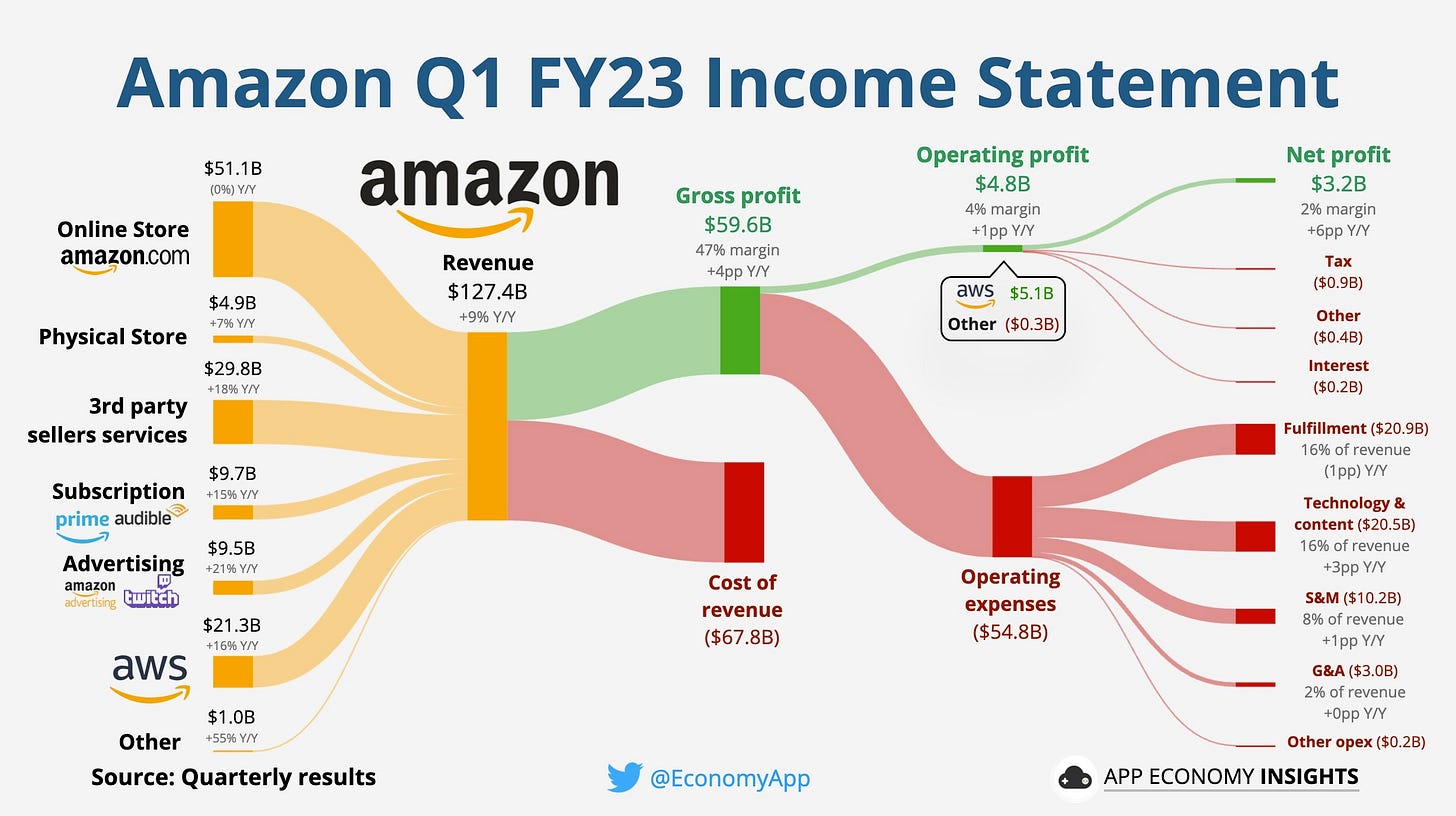

AMZN —Cloud dominator

Revenue +9%

Operating income +23%

Operating cash flow +38%

Good

✅ Announced new AWS tools (Amazon Bedrock, CodeWhisperer) for easy building with AI

✅ New commitments and migrations from AWS customers

✅ Strong revenue growth of 23% in its advertising unit

Ugly

❌ Weakest year in sales growth as a public company

❌ Slowing sales in online shopping and cloud computing divisions

Summary

✳️ Amazon remains the market leader in Cloud services with 32% market share, with Microsoft next in line at 23%.

✳️ Will Amazon be able to hold on to its lead? If unsure who will dominate, why not get both?

Conclusion

For AI, the best bet looks to be Microsoft.

For Cloud, it’s Amazon.

For search engine, it’s Google.

Of the 3, based on the latest earnings reports, Microsoft edges it for me over amazon (saying this as an Amazon shareholder).