Good Company, Bad Investment

I was wrong about Berkshire Hathaway.

Through no fault of the company, but my own.

I used an excessively high growth rate in my calculation, which gave me too high an intrinsic value.

My only saving grace?

The stock went up after I bought it, and I got out at a profit.

I am a firm believer that there’s a price to pay for everything.

A great business can be a lousy investment at the wrong price.

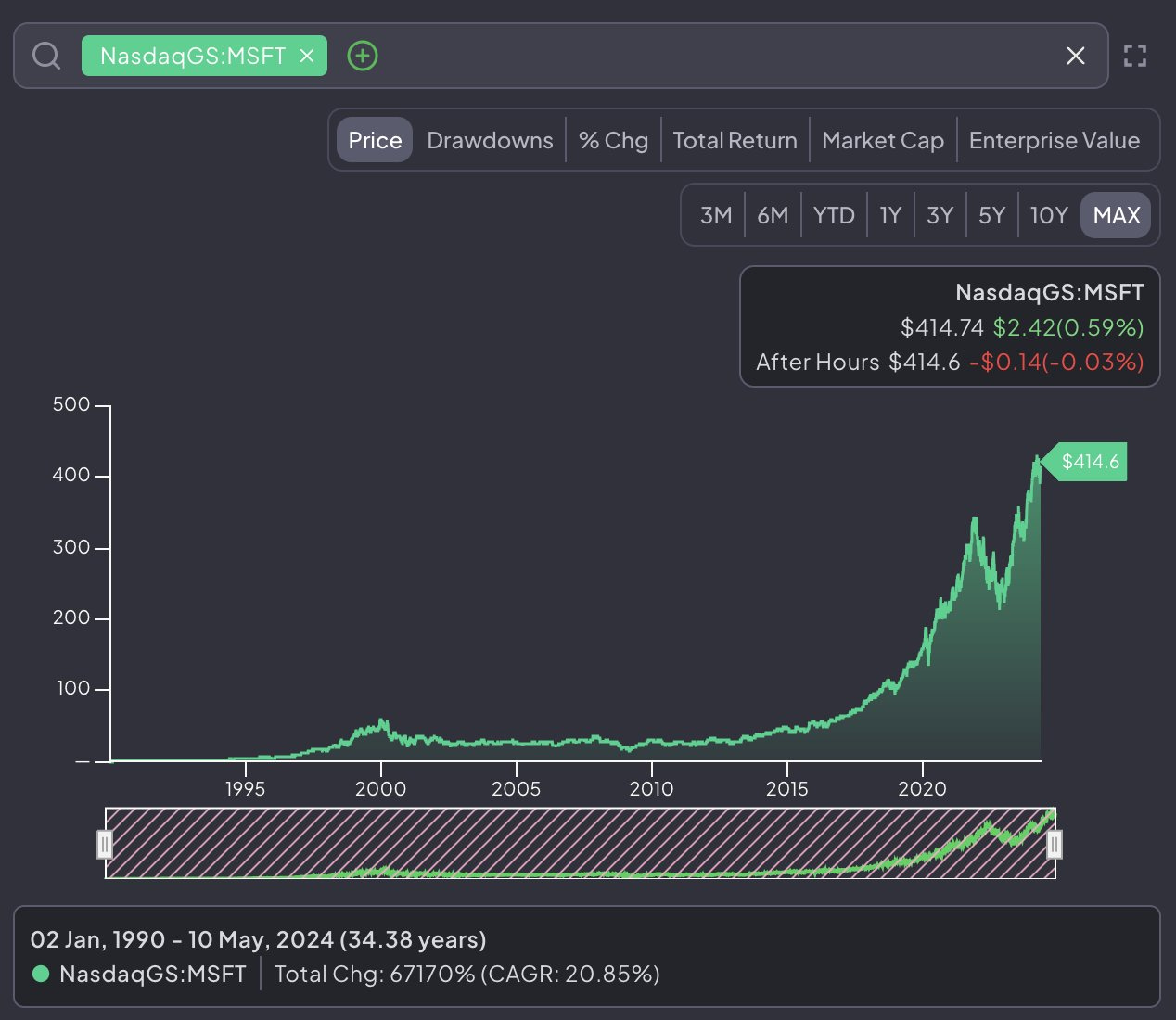

Consider the largest company in the world by market cap, Microsoft (MSFT).

The company gave investors a total return of 0% from 2000 to 2016.

Despite this dry spell, the company recorded a total return of 67,170% over 34 years, a CAGR of over 20%.

Does this mean that Microsoft (MSFT) is a bad business?

No.

It just meant that Microsoft was overvalued during that period.

What we pay matters, even for the best companies in the world.

The kind of business that I love

I love businesses that have recurring income.

Income that arrives like clockwork, quarter after quarter, year after year.

Salesforce is my new fling, the girl that I broke up with Warren Buffett for.

I’ve used their systems in my current job, and my previous job.

I’ve seen my employer change other systems and/or service providers, but never their CRM system.

The “stickiness” of their products and services is what attracted me, sticking to me like bees to honey.

The Company derives its revenues from two sources:

Subscription and support revenues (93%)

Subscription fees from customers accessing the Company’s enterprise cloud computing services (collectively, “Cloud Services”)

Software license revenues from the sales of term software licenses and support revenues from the sales of support and

Updates beyond the basic subscription or software license sales.

Professional services and other revenues (7%)

Professional and advisory services for process mapping, project management and implementation services and training services.

Things I like to see

Growing their main revenue source (Subscription and Support Revenue) at a CAGR of 25%.

Growing their Cash from Operations at a CAGR of 27%.

How much is Salesforce (CRM) worth?

Calculating the intrinsic value of a company doesn’t have to be hard.

We only need a few numbers into our discounted cash flow (DCF) calculator, plug it in and viola!

Operating cash flow

Total debt

Cash and Short Term Investments

Shares outstanding

These are factual numbers, there’s no subjectivity about them.

Cash flow growth rates

Discount rate

The subjectivity comes in when deriving growth and discount rates.

This is hugely important, as different rates give us wildly different valuations.

If I’m using operating cash flow in my DCF, I use the growth rate of the company’s operating cash flow (which is 25% in this case).

My 20 year discounted cash flow consists of 3 parts:

Years 1 to 5: Cash flow growth rate of 25%

Years 6 to 10: Cash flow growth rate of 12.5%

Years 11 to 20: Cash flow growth rate of 4%

Projecting a cash flow growth rate of 25% in the first 5 years, then halving this to 12.5% in the subsequent 5, and then using the US long term GDP growth rate in the last 10 years.

As for discount rate, 10% is commonly used.

When estimating discount rate to use, I ask myself “What is the rate of return of an alternative investment that I can reasonably get?”

The long-term return of the S&P500 is around 7 to 10%.

To be conservative, I use 10%.

The higher the discount rate, the more conservative the valuation is.

Rebalancing the portfolio

This is the first time I’ve rebalanced my portfolio.

Doing something for the first time always feels uncomfortable.

Selling a company like Berkshire didn’t feel comfortable. Berkshire’s share price could still rise, and I’d be fine with it.

Investing is a game about finding the most undervalued picks in the stock market.

If this means I have to sell a good company that is overvalued, then so be it.

I hope you enjoyed reading this piece as much as I did writing it.

If you’d like to connect, I am spending a lot more time on Twitter/X these days. Follow me over there for more investing and personal finance content