A market correction, defined as a 10% to 20% decline from a market index's peak, is often accompanied by widespread negative sentiment.

Sentiment that is often fabricated by analysts.

For individual investors, significant unrealised portfolio losses can be emotionally challenging.

However, like a physical wound, fundamentally sound companies within a portfolio will eventually recover.

These corrections should be viewed as opportunities that get us excited, and not causes for alarm.

The key is to prepare before the event, and not during the event.

But how exactly should we prepare ourselves for this?

How to Prepare?

I love stock market drawdowns.

I’ve been underprepared during the last few, so I’m not going to make the same mistake again when the next one comes along.

Set up an emergency fund

Think of your emergency fund as your 'keep the lights on' money, not investment money.

Any capital beyond these funds should be considered 'dry powder' for strategic market investments.

You don't want to be in a position where you have to sell your stocks at a loss just to pay your bills.

Decide on our investment strategy

Once an emergency fund is in place, it's time to develop an investment strategy.

For risk-adverse investors seeking stability, broad market index funds like SPY or VOO are a good starting point - a basket of 500 stocks isn't bad at all.

If you can handle company-specific risk of picking individual stocks, there’re a multitude of options.

With stocks, the potential for substantial returns outweighs the inherent volatility associated.

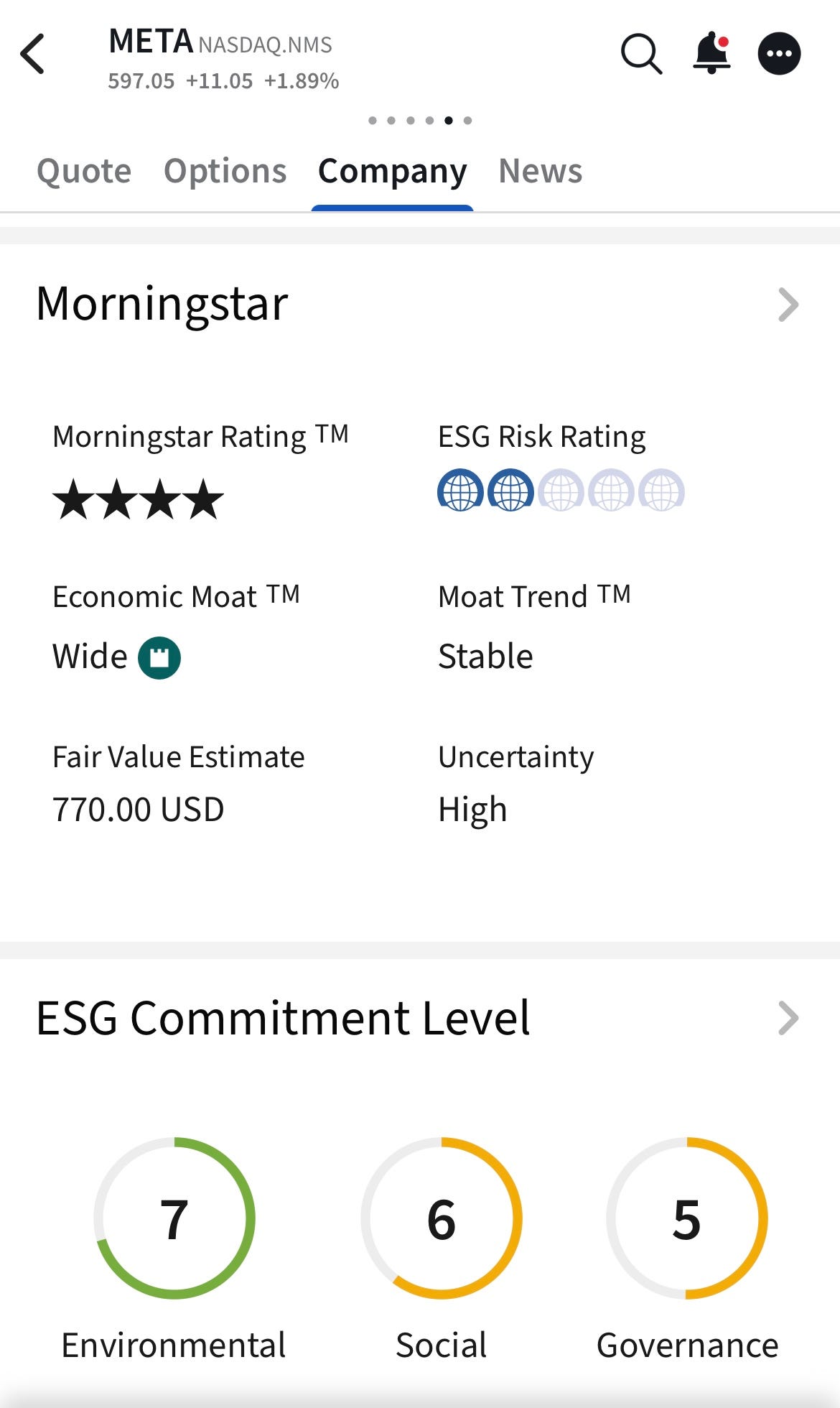

The ability to calculate intrinsic value is essential for picking individual stocks, but the IBKR platform provides a quick estimation.

Morningstar's fair value estimate for Meta is $770, but my calculated intrinsic value is $674.

To maintain a conservative approach, I use the lower figure of the two.

How do I know what to buy

When the next market correction arrives, prepare by considering:

How much available cash reserves do I have?

What are the top performing stocks in my portfolio?

Which of these stocks are the most undervalued?

My investment rule focuses on stocks with proven returns.

This means I prioritise adding to my portfolio's best performers when they become undervalued.

While other potentially undervalued stocks outside of my holdings exist, some with the allure of being potential multi-baggers, I am mainly focused on sticking with my current portfolio unless an exceptionally undervalued opportunity arise.

As the saying goes, failing to plan is planning to fail.

When preparation meets opportunity, the magic of compounding happens.