Buying the dip might sound like good advice. But what if the dip keeps dipping? Like what we’re seeing now. Every dip looks like a good buying opportunity, until it keeps dipping with no end in sight.

At what point do we know when it’s good enough to buy? Let’s start by exploring the most recent Covid crash.

The Covid-19 Crash of March 2020

On March 22, 2020, the S&P 500 was down about 33%. The market would have to gain 50% to get back to even. Every dollar invested on March 23, 3030 would eventually grow to $1.50, assuming the market recovered to its previous level at some point in the future.

Within six months the S&P 500 was hitting all-time highs again. Those who had bought on March 23 had a 50% gain within half a year. However, even if the recovery had taken years longer, buying on March 23, 2020 would still have been a great decision. All you had to do was to reframe how you thought about the upside.

How To Reframe Your Upside

Most market crashes provide opportunities for a 50% to 100% upside. Every percentage loss requires an even larger percentage gain to breakeven. Losing 10% requires an 11.11% gain to recover, losing 20% requires a 25% gain to recover, and losing 50% requires a 100% gain (a doubling) to recover.

We know that a 33% loss requires a 50% gain to get back to even. Now that we know how long we expect the market recovery to take, let’s turn that 50% upside into an annualised number.

The formula for this is:

Expected Annual Return = (1 + % Gain Needed to Recover) ^ (1 / Number of Years to Recover) -1

If you think the market recovery will take:

1 year, your expected annual return = 50%

2 years, your expected annual return = 22%

3 years, your expected annual return = 14%

4 years, your expected annual return = 11%

5 years, your expected annual return = 8%

Even in a scenario where the market took half a decade (5 years) to recover, you would still earn an 8% return while you waited.

What are your annualised returns after buying during a 30% drawdown?

A 30% drawdown is normally a good sign to start deploying your capital. There’s more than a 50% chance that you’ll get more than 10% annualised returns.

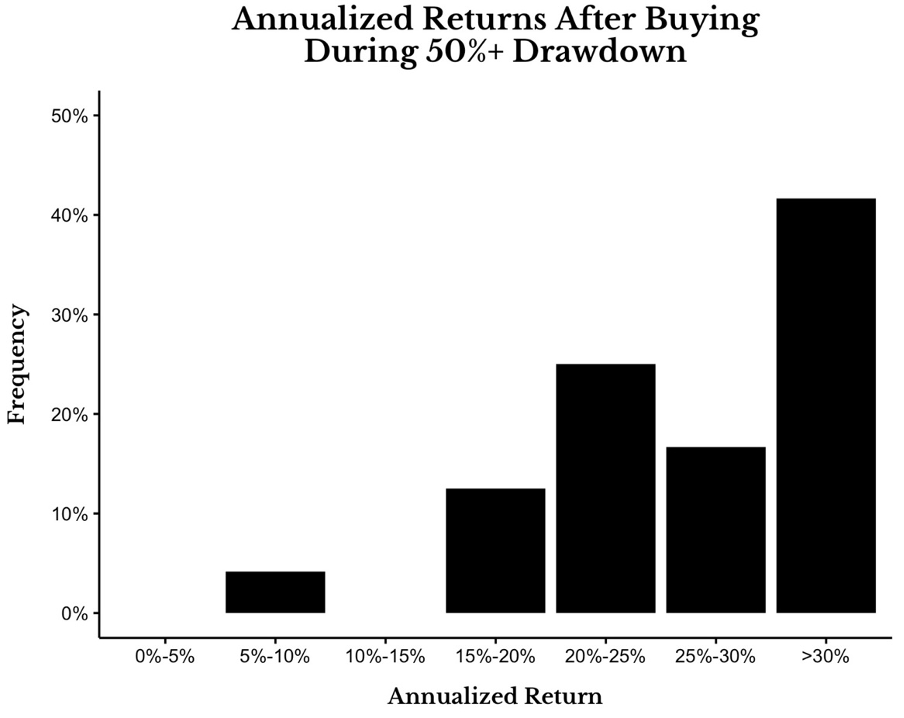

What are your annualised returns after buying during a 50% drawdown?

Once the market drops by 50% or more, it almost certainly means it’s time to buy. More than 90% of the time, your annualised return would be upwards of 15%. A 50% drawdown doesn’t happen too often, which is why you should grab the opportunity when it presents itself.

Are The Odds In Our Favour?

As with all things in life, some notable exceptions apply. The Japanese stock market was still below its December 1989 highs over 30 years later at the end of 2020.

At the end of 2020, Russian stocks were down 50% and Greek stocks were down 98% from its 2008 highs.

That being said, most equity markets go up most of the time. Yes, there may be occasional periods of poor performance over longer time periods. Even U.S stocks had a lost decade from 2000-2010.

After analysing developed equity market returns across 39 countries from 1841 to 2019, researchers estimated that the probability of losing relative to inflation over a 30-year investment horizon was 12%. This means that there is roughly a 1 in 8 chance that you expect an investor in a particular equity market to see a loss of purchasing power over three decades.

There is a 7 in 8 chance that an equity market will grow its purchasing power over the long run. These are odds that I’ll happily take.

“Fear has a greater grasp on human action that does the impressive weight of historical evidence.”

Conclusion

The wise thing to do is to divide your capital into 2 to 3 tranches. The first tranche could be deployed when the market falls 30%. When I say the market, I mean a broad-based market index like the S&P 500. Individual stocks carry company-specific risks and may not recover even when they fall.

“The time to buy is when there’s blood in the streets.”

Easier said than done. Majority of people don’t dare, do you?