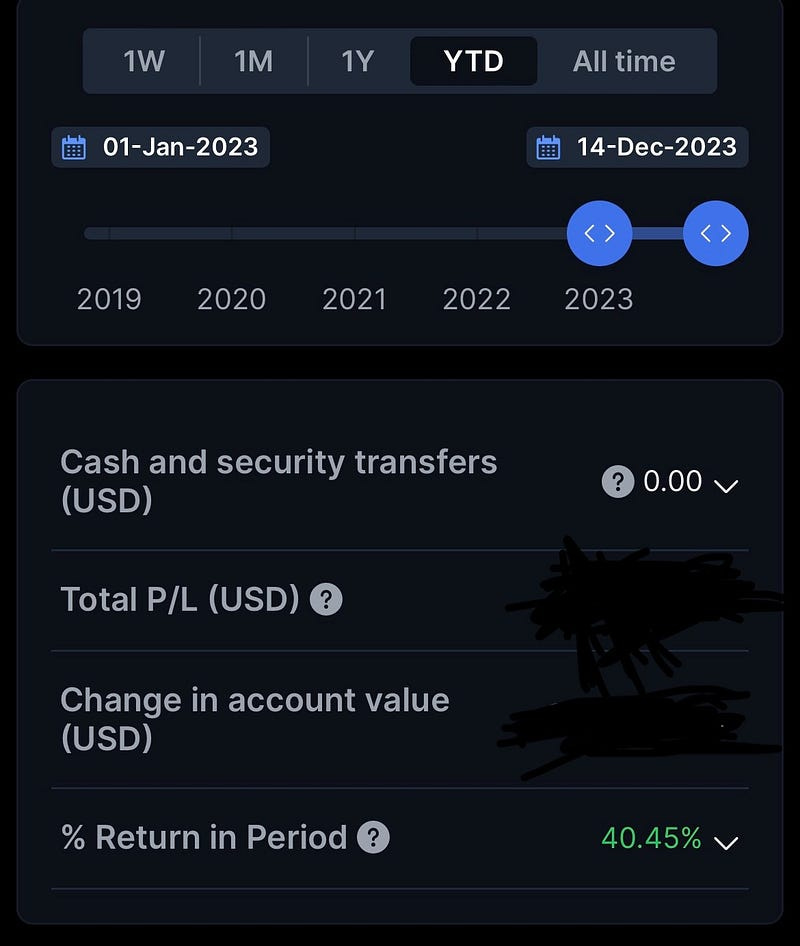

How sitting on my ass has gotten me a 40% annual return in 2023

When inaction is the best form of action

How often have we been told that “Practice makes perfect”.

This is generally true in most fields.

Most of the time, performance in a given field improves with practice over a long period of time.

To improve our writing, we simply write more.

To improve our physical fitness, we simply exercise more.

To become a high performer in our day jobs, we take on more tasks, working more and harder.

Take Cristiano Ronaldo for example. Someone who is still scoring goals despite being almost 40. First on the training ground and last to leave.

It’s no wonder that people are advocating doing more to become good at something.

Practice makes perfect seem to be good advice in most scenarios, except one.

Less is more

The exception is when investing.

As an investor, doing less is doing more.

Doing nothing can bring better results than constantly trying to outsmart the stock market.

It’s hard to think of it this way, when we have been taught the opposite for so much of our lives.

There is no “holy grail” to investing. Trying to find one will lead to disappointment.

Investing is all about finding a strategy that works, one that suits your risk tolerance.

Why I prefer lower returns

Contrary to popular belief, it’s not about optimising your portfolio for the highest returns.

30% per year compounded for 11 years will give you a great return.

15% per year compounded for 50 years is a vastly bigger return.

The secret does not lie in the rate of return, but time.

An average return year after year will become a great one over decades.

How inaction has helped me in investing

My saxo account is what I call a “Do not touch” account”.

I have neither added or sold any positions for years.

With the exception of the bear market in 2022, the portfolio has been chugging along nicely.

In bull years (which occurs 70% of the time), the portfolio will outperform the market most of the time.

In bear years (which occurs 30% of the time), however, it underperforms the market. This is a risk I am willing to take, as it doesn’t happen too often.

Conclusion

You don’t have to be an expert to do well in investing.

You don’t need to trade in and out of the market.

Find a strategy that works, is sustainable over a long period, and double down on that.