I have made my fair share of investment mistakes.

From chasing the next big thing, to following the stock picks of “finfluencers”. I’ve done them all.

It’s only human to make mistakes.

What matters is how we remedy these mistakes. This is why position sizing is so important in preventing our portfolios from blowing up.

As my “mistakes” only form a small portion of my overall portfolio, I’m able to live to fight another day.

While the core of my portfolio remains solid, there are some small bets I took that haven’t worked out.

Selling them at a loss might sound like the right thing to do, but it doesn’t really move the needle for me.

“If I’m not going to sell them, what else can I do?”

“Why not sell options to generate some income from these losing positions?”

On Selling Options

The premiums collected from options selling is similar to dividends received from stocks we hold.

But there is one BIG caveat that comes with selling options - Assignment.

This is something that many option sellers overlook. It’s a big mistake to just look at the juicy premiums we’re getting.

Assignment does happen more often than we think, and we need to be prepared in case that happens.

For covered calls, the “assignment” comes from your stock being “called away” upon hitting or exceeding your strike price by expiration.

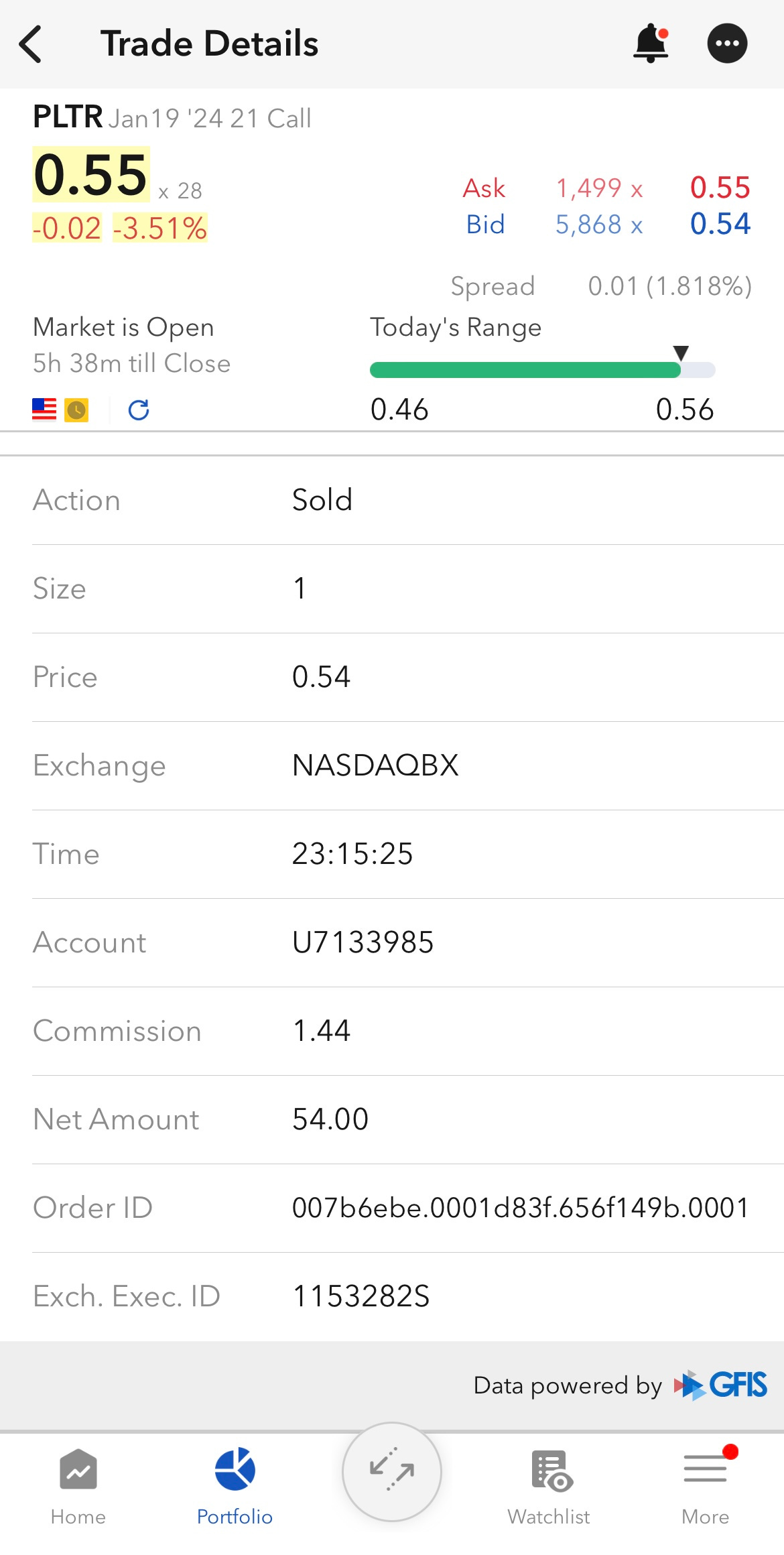

PLTR Trade

PLTR was a stock I bought a long time ago, when everyone was hyping it up.

It was a mistake was because I bought it even though my intrinsic value calculations told me otherwise.

Talk about having the discipline in sitting on your ass. My ass was clearly too itchy.

I bought this stock at around $18, so it’s about breakeven at current market price. I do think PLTR has some runway to go as it just turned profitable recently. However, it’s not a company that I have huge confidence in.

Since it’s a small position, I’m going to hang tight in the hopes that it may take off.

On 5-Dec-23, I sold a covered call at a strike price of $21, collecting a premium of $54.

This seems sensible, given how the charts look.

I am no charting expert, but a simple trendline shows that $21 seems to be the resistance.

IBKR tells me that the probability of profit for this trade is 80%. I like taking these high probability trades.

In the scenario that PLTR reaches $21 or above by expiry 19 Jan 24, my shares will be sold at $21. This is a $300 profit (or 16.67% return) from my cost basis of $18.

Add to that the premium I collected and I’m looking at almost a 20% return in 45 days. I’ll happily take that.

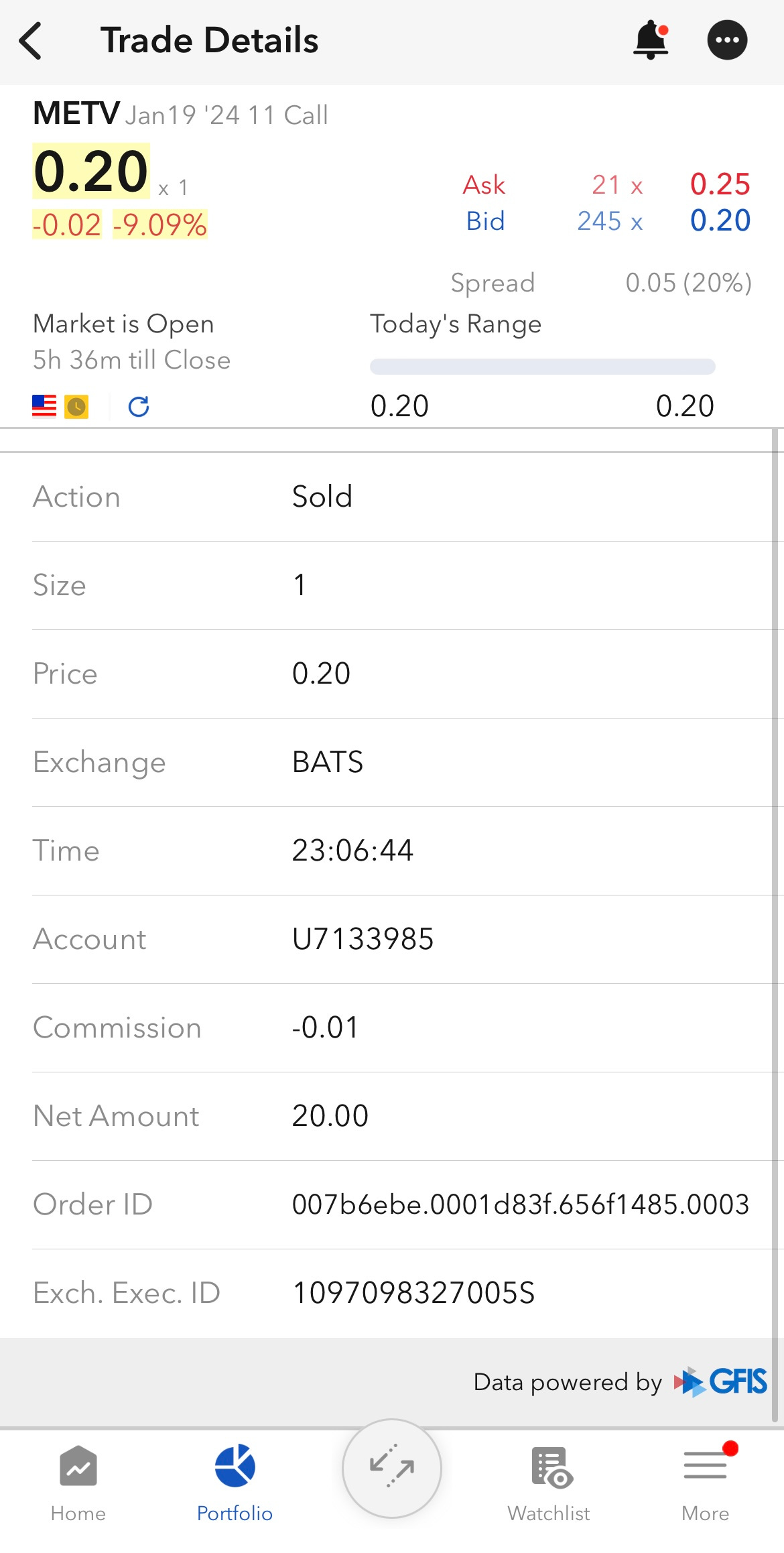

METV Trade

The other trade that I did was on METV. Another losing position that I initiated when betting on the metaverse.

Again, I sold a covered call on METV.

As METV is an ETF, premiums are not that great. In general, we’re looking at a 1% to 1.5% return for option premiums on ETFs.

In this case, it’s about 1.82% which is fairly decent for an ETF.

$20 isn’t much, but for such a low priced security, I’ll take it.

Not a technical analysis expert, but a quick look at the charts show $11 as the resistance level.

IBKR tells me that the probability of success of this trade is around 68%. The probability of profit for this trade isn’t as high as PLTR but still decent nonetheless.

In this case, I’ll lose around $380 ($400 less $20 premium collected) if METV hits $11 or above by 19 Jan 24.

But I can always roll the option out to a further expiration date if this happens.

Open your IBKR account here: https://ibkr.com/referral/benedict531