How I became "bankrupt" from investing "too much"

Do this so you don't make the same mistake as me.

The stock market has left me “bankrupt”.

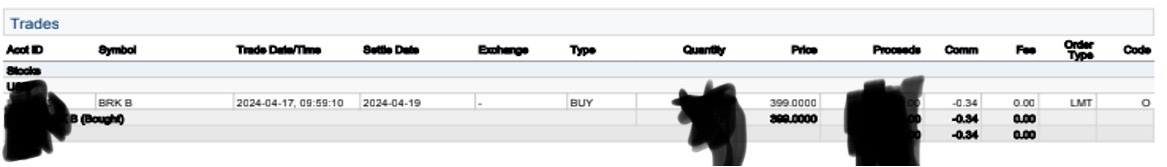

Just this month alone, I have bought shares of 2 US stocks.

Then when Meta fell due to higher AI capex guidance despite solid earnings, I realised I was running low on cash.

No more bullets to deploy.

This taught me a lesson, which until now I hadn’t realised.

A warchest and emergency fund are 2 different things.

My mistake was that I used to view them as one and the same.

This also sparked a thought in my head “How much cash should we be holding in our portfolio?”

Am I holding too little?

Warchest

Warchest refers to cash sitting on the sidelines, waiting to be deployed in times of war (in the markets, not in real life).

Having a sizeable warchest allows us to capitalise opportunities presented by market downturns.

One mistake that I made was combining both my warchest and emergency funds, leaving me with insufficient cash.

Call me crazy but I am someone who gets most excited when I see my favourite stocks coming down to my buy levels.

Imagine the feeling I got when I realised my warchest wasn’t big enough.

While there’s no magic number, I would say at least 15% of our liquid net worth.

For every $100,000, that’s $15,000 in the warchest.

The amount in our warchest is likely to increase when the market goes up, a time when opportunities are few and far between.

And that’s fine.

Emergency fund

Without trying to state the obvious, the size of this fund depends on our individual circumstances.

A breadwinner in a family of 5 will need a larger emergency fund than a single with no dependents.

This can be adjusted to account for inflation and other needs as we age.

We can ask ourselves a few questions:

What are our monthly expenses on average over the last 12 months (both our own and our dependents)?

How old are we?

Like it or not, we live in a world where the younger we are, the easier it is for us to get a job.

It is easier for someone in their 20s to land a job than someone who is in their 40s.

If we are in our 20s, 6 months worth of expenses may be sufficient.

If we are in our 30s, 12 months.

If we are in our 40s, 24 months.

You get the gist.

Maintain 2 different accounts

It can get a little messy if we keep both our emergency funds and our warchest in the same place.

That’s what happened to me- when I combine both, I’m left with insufficient funds.

We want to keep our emergency funds in a high-yield savings account. Somewhere that’s highly liquid and easy to access when emergencies arise.

Our warchest monies can either be kept in a brokerage account, or a separate high yield savings account.

If you have faced a similar situation before, you’ll know the importance of separate the 2 accounts.

I hope you enjoyed reading this piece as much as I did writing it.

If you’d like to connect, I am spending a lot more time on Twitter/X these days. Follow me over there for more investing and personal finance content