Investing can be as simple or complicated as you make it out to be.

Others might disagree but I like to keep my investments stupid and simple (KISS).

I optimise for peace of mind, instead of the highest returns for my investment portfolio.

Here’s my strategy for my U.S portfolio.

My U.S portfolio comprises a combination of Portfolio 1 and 2.

Portfolio 1: more stable, lower risk but lower return

Portfolio 2: more volatile, higher risk but higher return

It’s important to consider the amount to be allocated for each portfolio.

Portfolio 1 will be about twice the size of Portfolio 2.

With a lower drawdown of 28% (Portfolio 1) vs 40% (Portfolio 2), this will help me weather the storm of a bear market.

I know that this is a drawdown I can stomach, and won’t panic sell when the bear (inevitably) returns.

While I am willing to sacrifice the higher returns Portfolio 2 might bring, it’s natural to want a little slice of the pie.

Since the drawdowns of Portfolio 2 are higher, a smaller allocation is needed.

I do have a SG portfolio as well, but I’ll be doubling down on investing in the U.S market, a market which served me so well in the last 5 years.

The goal is to double down on what has been working for me.

Automating My Investments

What good is having a plan if you can’t execute it?

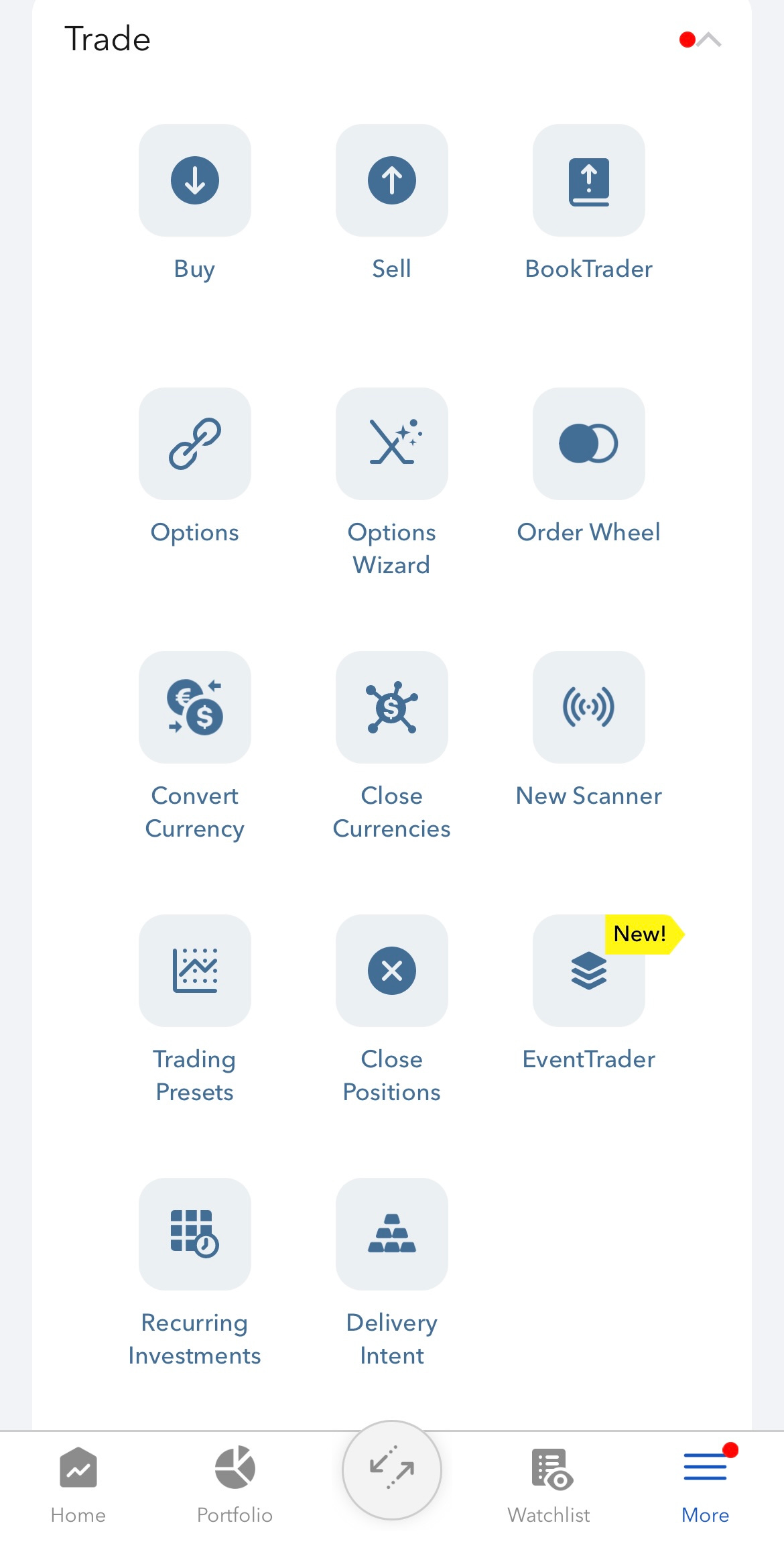

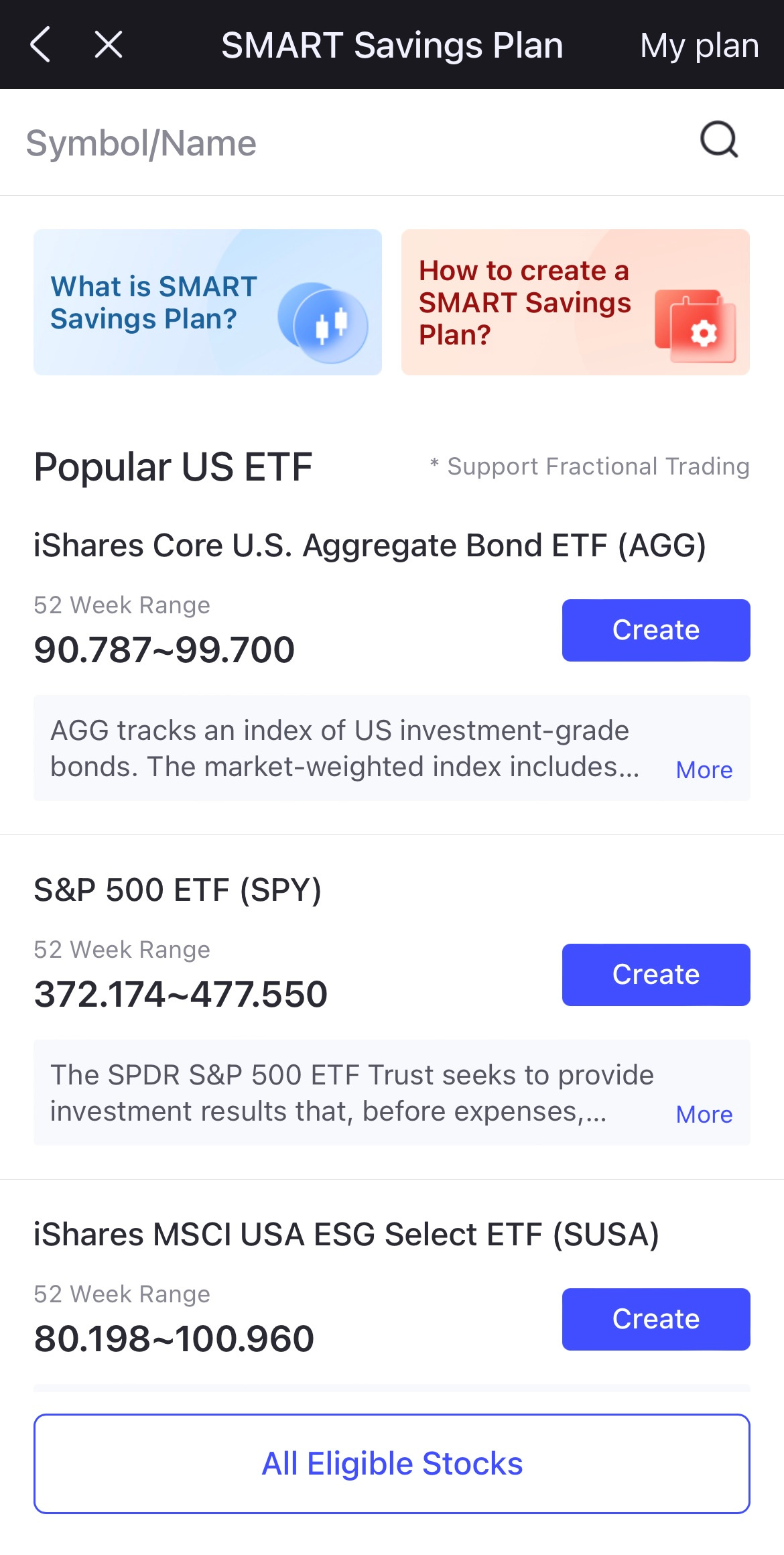

This is why I make use of the recurring investment feature on IBKR and USMART.

2 things I like about automation:

No emotions involved

Removes decision fatigue - no need to think if this is the right time to buy

Here’s how the auto-invest feature in each brokerage looks like:

Interactive Brokers (IBKR)

IBKR: https://ibkr.com/referral/benedict482

uSMART: https://m.usmartsg.com/promo/overseas/bonus-dec.html?ICode=ux55&langType=3&Id=

If you haven’t yet, consider opening an account with one of the brokerages, and start automating your investments.

Conclusion

Each portfolio is unique, reflecting distinct risk tolerances.

A well-constructed portfolio considers your risk appetite, ensures adequate (but not too much) diversification, and is rooted in strong fundamentals at a fair price.

Wishing you a happy and wonderful 2024 ahead!