Gift yourself a red packet this CNY with these 2 Singapore dividend stocks

It's less complicated than growth stocks.

The Lunar New Year season is upon us.

If you’re looking for an extra red packet, look no further than the Singapore stock market (SGX).

Sure, the SG stock market has often been criticised for its lagging returns, when compared to its US counterparts.

But if there’s 1 thing that the SG stock market is good for, it’s good old-fashioned dividends.

The problem is not all dividend stocks are created equally. However, finding the right ones don’t have to be hard.

Here’re 3 simple ways to identity a dividend stock that will serve you well.

1. Stock goes up over time

Over the long-term, the direction of the stock price will follow the business.

If the underlying business of the company does well, its stock price will rise in tandem, and vice versa.

2. Dividend yield is not abnormally high

The dividend yield of a company is affected by 2 factors:

Annual dividends per share

Current share price

For a company to have a high dividend yield, either 1 of 2 things have to happen:

Increasing annual dividends per share

Falling share price

Most times, it’s the latter.

A falling share price over a prolonged period is a red flag.

3. Dividends are growing

Growing dividends over a long period of time is a sign that the company has a strong moat.

Also check that they are not using debt to pay your dividends.

Let’s explore 2 stocks listed on SGX that meets these 3 criteria.

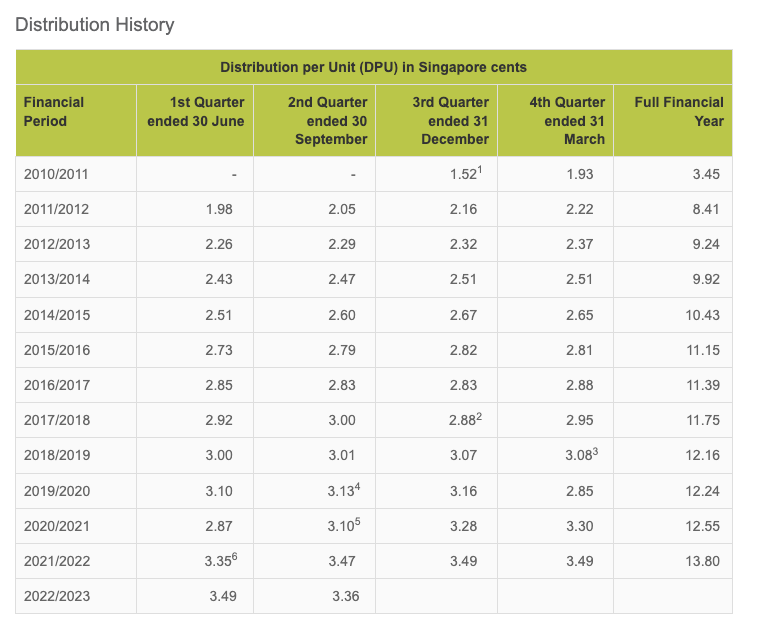

Mapletree Industrial Trust

MIT has 85 properties in Singapore and 56 properties in North America.

MIT’s property portfolio includes Data Centres, Hi-Tech Buildings, Business Park Buildings, Flatted Factories, Stack-up/Ramp-up Buildings and Light Industrial Buildings.

The stock has gone up 108% since inception on 22 Oct 2010.

Annualised return (excluding dividends) = 6.04%

With dividends included, it’ll be well above 10% return per year.

Dividend yield = 6+%

Over the last 10 years, MIT has grown their dividends by about 5% per year.

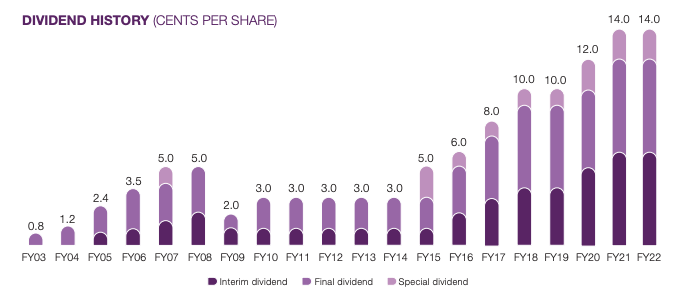

Micro-Mechanics Holdings Ltd

Micro-Mechanics designs, manufactures and markets consumable parts and precision tools used to assemble and test semiconductors.

The stock has gone up an incredible 514.29% since inception in 30 Sept 2005.

Annualised return (excluding dividends) = 10.9%

With dividends included, the figure goes to about 15% or more.

Dividend yield = 5+%

Over the last 19 years, the company has grown their dividends by about 16% per year.

Conclusion

Finding good dividend stocks don’t have to be complicated.

The simpler and leaner your process is, the more likely you’ll be to invest.

Too many cooks spoil the broth. Don’t over-complicate things.