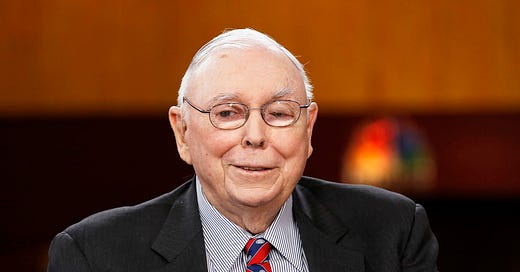

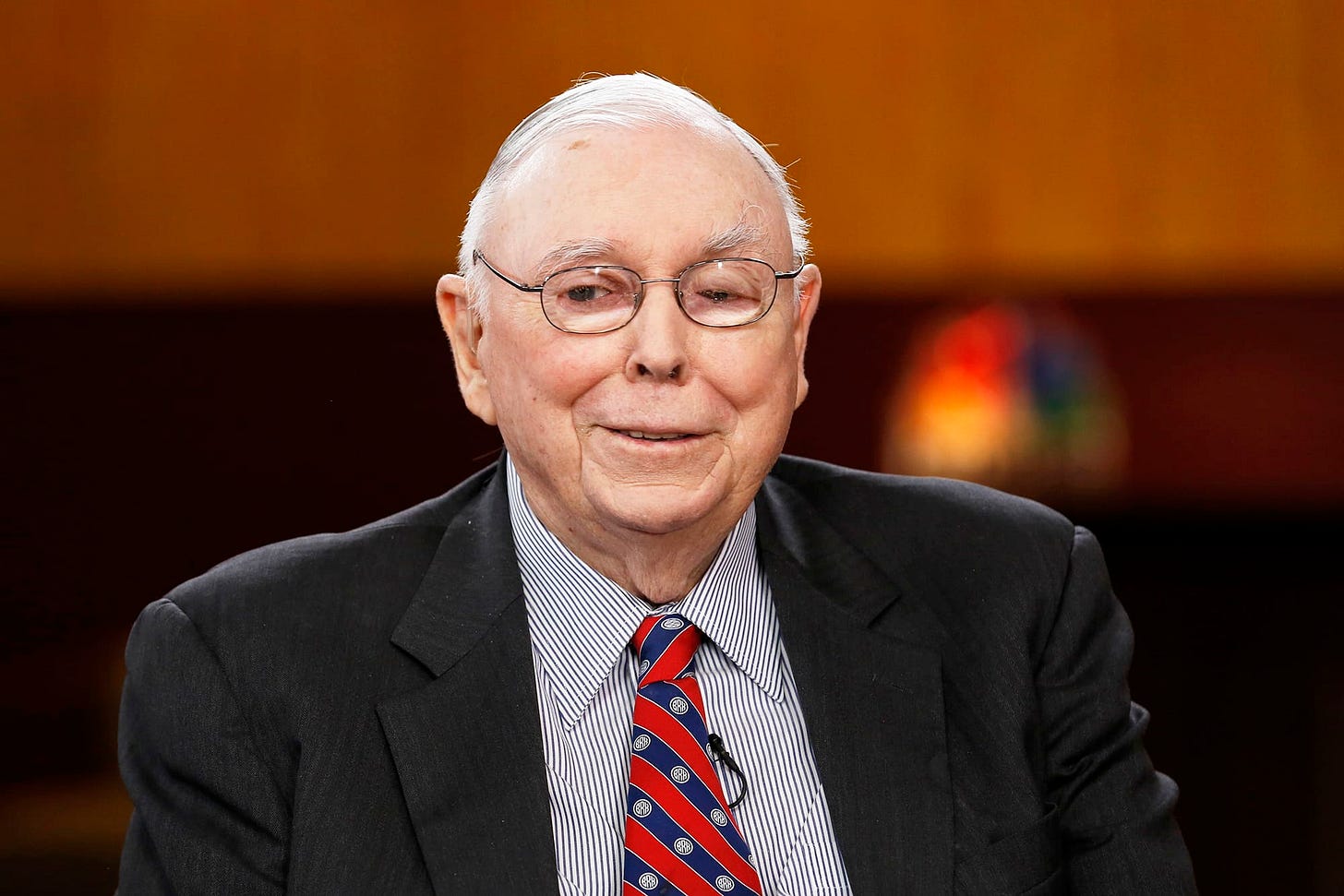

Charlie Munger passes at 99: What we can learn from the investing legend

99 years of wisdom summarised

Unless you’ve been living under a rock, you’d know that Charlie Munger has passed away at the ripe old age of 99.

As co-founder of Berkshire Hathaway with Warren Buffett, he has been widely regarded as one of the greatest investors in the world.

One of my favourite quotes from Charlie:

Live within your income and save so that you can invest.

So simple yet so difficult to follow.

In his time on earth, he has taught us many life and investing lessons.

Here’re 6 of them that stuck with me.

Be rational and objective

Be it in life and investing, being emotional is never helpful.

No matter how rational you think you are, we as humans fall prey to irrationally a lot of the time.

It’s the number one reason why people fail at investing - not due to lack of ability but due to an inability to control their emotions.

It’s why automating the process has worked wonders for me.

Be a learning machine

Learning is a lifelong journey. It should not stop once we finish school.

The world is changing at breakneck speed. New technologies are emerging year after year.

It’s why being in a constant flux of learning is so crucial. The main essence of it being reading… A LOT.

Financial freedom is about independence

Charlie Munger had a considerable passion to get rich.

However, the desire to get rich wasn’t driven by fast cars or yachts. Instead, the purpose of getting rich was to become independent.

Freedom to do whatever he wants on a daily basis.

The biggest dividend money pays.

Don’t fall for salesmanship of the investment industry

Charlie believes that only 5% of fund managers can beat the performance of an index fund.

Trusting a fund manager with your money is like asking your barber whether you need a haircut.

There’s a conflict of interest.

No one cares about your money more than you do.

Concentrate your bets

Sure, a concentrated portfolio could lead to heavy losses if you don’t know what you are doing.

But if you do, the rewards from having a concentrated portfolio are immense.

In poker terms, bet heavily when the odds are in your favour.

Invert, always invert

A lousy question is “How can I make the most money?”

A better question would be ”How can I not lose money?”

Protect your downside before looking at your upside. “What can go wrong” is an excellent question to ask.

Applies to both life and investing.

Conclusion

After Charlie’s passing, we will certainly miss the wisdom and knowledge that he brings to this world.

May he rest in peace.