Psychologically, averaging up is hard.

It’s hard to buy something at a higher price once you own them at a lower price.

We’re so fixated on the price we paid for something in the past that we can’t bring ourselves to pay a higher price now.

What we fail to account for is that the value of that asset might’ve gone up.

For some reason, investors like to average down on their holdings.

It’s as if they enjoy compounding their losses in a stock.

Not a bright idea.

How has Alphabet’s share price performed?

Alphabet has under-performed the S&P500 year-to-date (YTD), returning 14% vs the S&P500’s 19%.

The company’s share price has fallen from its peak of $192 to $150, a 22% correction.

All in a matter of 2 months.

Anything that falls this much in such a short span of time is worth a further look, even more if we’re talking about a big tech company.

What’s behind Alphabet’s stock price decline?

1. Antitrust Case

Big tech companies are commonly hit with antitrust cases, particularly if they have a monopoly in a certain segment.

Google is the default search engine on many devices, including Android and Apple. In doing so, they have insulated themselves from competition.

This is not the first time that Google has faced antitrust regulations, and will not be the last.

Even they’re not the default search engine, chances are people will still be using Google as their go-to platform for search.

After all, when was the last time you used Bing, or Yahoo, or even Duckduckgo?

That’s not all.

Google has also been accused of having an illegal monopoly on the ad-tech market. The company both owns the market, and competes in it, in the form of buying and selling digital ads.

This is something the DOJ doesn’t like, but investors in the company should.

2. Losing its verb status

This one’s a little ridiculous.

In the past, Millennials used to say “Google this, google that.”

This appears to be changing, with Gen Zs using the term “search” rather than “Google.”

Gotta ask my Gen Z friends about this.

The Fundamentals

A stock purchase is similar to a property purchase.

Just like how you wouldn’t just buy any property without proper due diligence, the same concept applies for buying stocks.

Google Search (57%)

The company’s main revenue generator, which includes revenues generated on:

Google search properties (including revenues from traffic generated by search distribution partners who use Google.com as their default search in browsers, toolbars, etc.)

Other Google owned and operated properties like Gmail, Google Maps, and Google Play

This segment continues to grow at a decent clip of 15.37% CAGR.

At least it’s comforting to know that people are still using Google search, and not a search platform named after an animal.

YouTube Ads (10%)

YouTube ads refers to revenues generated on YouTube properties.

Growing at 19.6%, I don’t see this slowing down anytime soon.

There’s an increasing number of people consuming content on Youtube nowadays, both for educational and entertainment purposes (the typical disclaimer that Youtubers make).

Google Network (9%)

Google Network is the slowest growing segment in Alphabet’s business.

This includes revenues generated on Google Network properties participating in AdMob, AdSense, and Google Ad Manager.

Google Subscriptions, Platforms, and Devices (11%)

Google subscriptions, platforms, and devices revenues are comprised of the following:

Consumer subscriptions, which primarily include revenues from YouTube services (i.e. YouTube TV, YouTube Music and Premium, NFL Sunday Ticket, Google One)

Platforms, which primarily include revenues from Google Play from the sales of apps and in-app purchases

Devices, which primarily include sales of the Pixel family of devices

Other products and services

Google Cloud (11%)

The fastest growing segment of the business, Google Cloud is already the second largest revenue generator behind Search, thanks to its incredible 37.6% CAGR.

Google Cloud revenues are comprised of the following:

Google Cloud Platform, which generates consumption-based fees and subscriptions for infrastructure, platform, and other services. These services provide access to solutions such as cybersecurity, databases, analytics, and AI offerings including AI infrastructure, Vertex AI platform, and Gemini for Google Cloud

Google Workspace, which includes subscriptions for cloud-based communication and collaboration tools for enterprises, such as Calendar, Gmail, Docs, Drive, and Meet, with integrated features like Gemini for Google Workspace

Other enterprise services

The segments likely to be affected by the antitrust case are Google Search and Google Network.

The likely outcome would be a fine, which Alphabet would be more than happy to pay given the strength of their balance sheet.

Why I’m buying

Riding on Joseph Carlson , a finance Youtuber and host of The Joseph Carlson show, I believe that there’re three main drivers that contribute to the intrinsic value of a company.

I tend to agree with most of his points, except that he takes a more conservative approach in using free cash flow growth vs my operating cash flow growth.

Organic revenue growth

Free cash flow growth

Predictability improving

Organic Revenue Growth

Google already has organic revenue growth. The company doesn’t have to make new acquisitions to grow its revenue.

Their products and services are so ingrained in our daily lives that it’s hard to envision what life would be without them.

Free Cash Flow Growth

What might shock many is that the company hasn’t grown its free cash flow in the past 3 years

It’s no surprise then, that the company’s share price has remained relatively flat in those 3 years.

That’s because capital expenditure (Capex) has increased. This capex is going into the technical infrastructure to grow the Cloud business.

Eventually, this will start to normalise, and we will see the free cash flow start to trend up.

Predictability Improving

The uncertainty around the company is the outcome of the lawsuit brought against the the DOJ.

We don’t know what might happen, or whether Alphabet might be broken up.

I suspect that they are just going to be fined, which Alphabet would be happy to pay with their huge cash pile.

As with every lawsuit brought against the company in the past, the current one will eventually pass.

Predictability will improve.

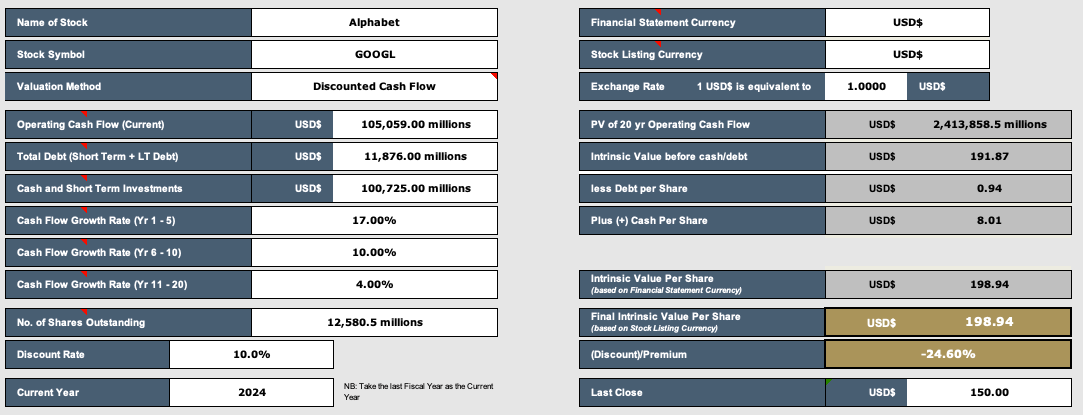

What’s the stock worth?

The final piece of the jigsaw — the intrinsic value of the company.

To me, this is the most important.

Ignore all narratives and market noises surrounding the stock — this is what determines whether or not I pull the trigger.

If you remember, I initiated a starter position in Alphabet stock earlier this year here.

My intrinsic value for the stock back then was $175.

I bought the stock at $138, representing a 20% discount.

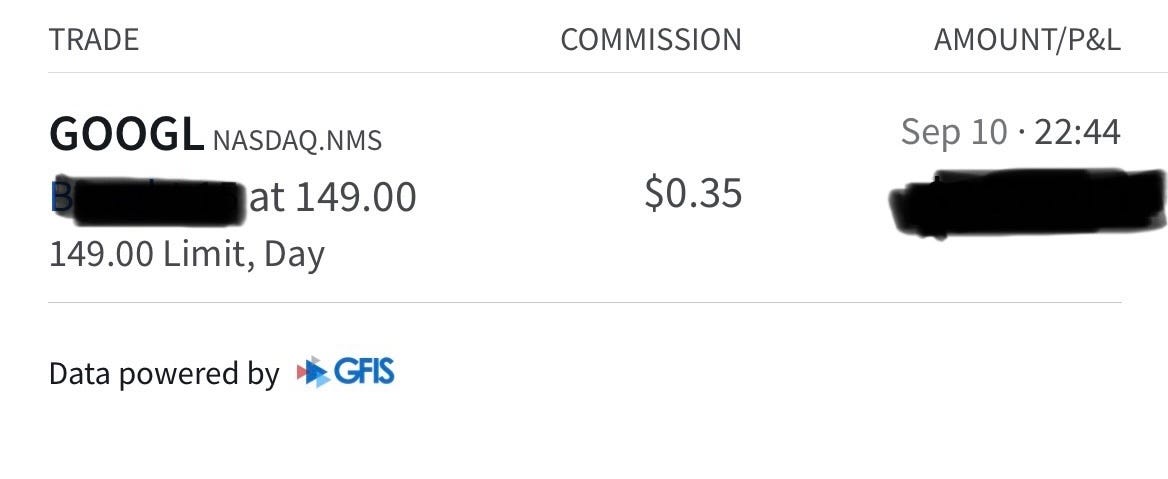

Things are different now.

The intrinsic value of the stock has risen to $198.

This time, I bought the stock at $149, at an even bigger 25% discount.

Price alone doesn’t tell us anything — actually knowing what a stock is worth does.

Combining this with a little technical analysis showing my buy levels:

Takeaways

The share price of high quality businesses always go up over time, in tandem with their increasing intrinsic value.

It’s not always a bad idea to average up on our holdings.

Ironically, that might be the wise thing to do.

In this instance, the share price decline proved too good to ignore.

I just had to take the bait.

P.S. — If you’d like to connect, I am spending a lot more time on Twitter/X these days. Follow me over there for more investing and personal finance content