Singapore stocks have been an unloved bunch. The SG market has been known to underperform the US market. In the last 5 years, the Straits Times Index (STI) has remained flat while the S&P 500 index (SPX) has returned about 68%. In spite of this, there are some undervalued gems to be had.

Here are 2 of them that have beaten the S&P 500 index over the last 5 years.

Parkway Life REIT

Parkway Life REIT is 1 of only 2 healthcare REITs listed on the SGX. Be it in good times or bad, people still need access to healthcare. This is what makes the REIT resilient, making it pandemic and recession proof.

The REIT’s portfolio is diversified with properties across 3 key countries in Asia, namely Singapore, Japan, and Malaysia. They own a total of 52 freehold properties and 4 leasehold properties, 3 of which are in Singapore.

Gross revenue and net income has been increasing, despite the slight decrease from FY20 to FY21. Distributions have been increasing from FY18 to FY21, after slight reduction in the prior 3 years.

5-Year Return

5 Year Return of S&P 500 ETF (SPY): +68.66%

5-Year Return of Parkway Life REIT (C2PU): +88.21%

Micro-Mechanics (Holdings) Ltd

Micro-Mechanics designs, manufactures and markets consumable parts and precision tools used to assemble and test semiconductors.

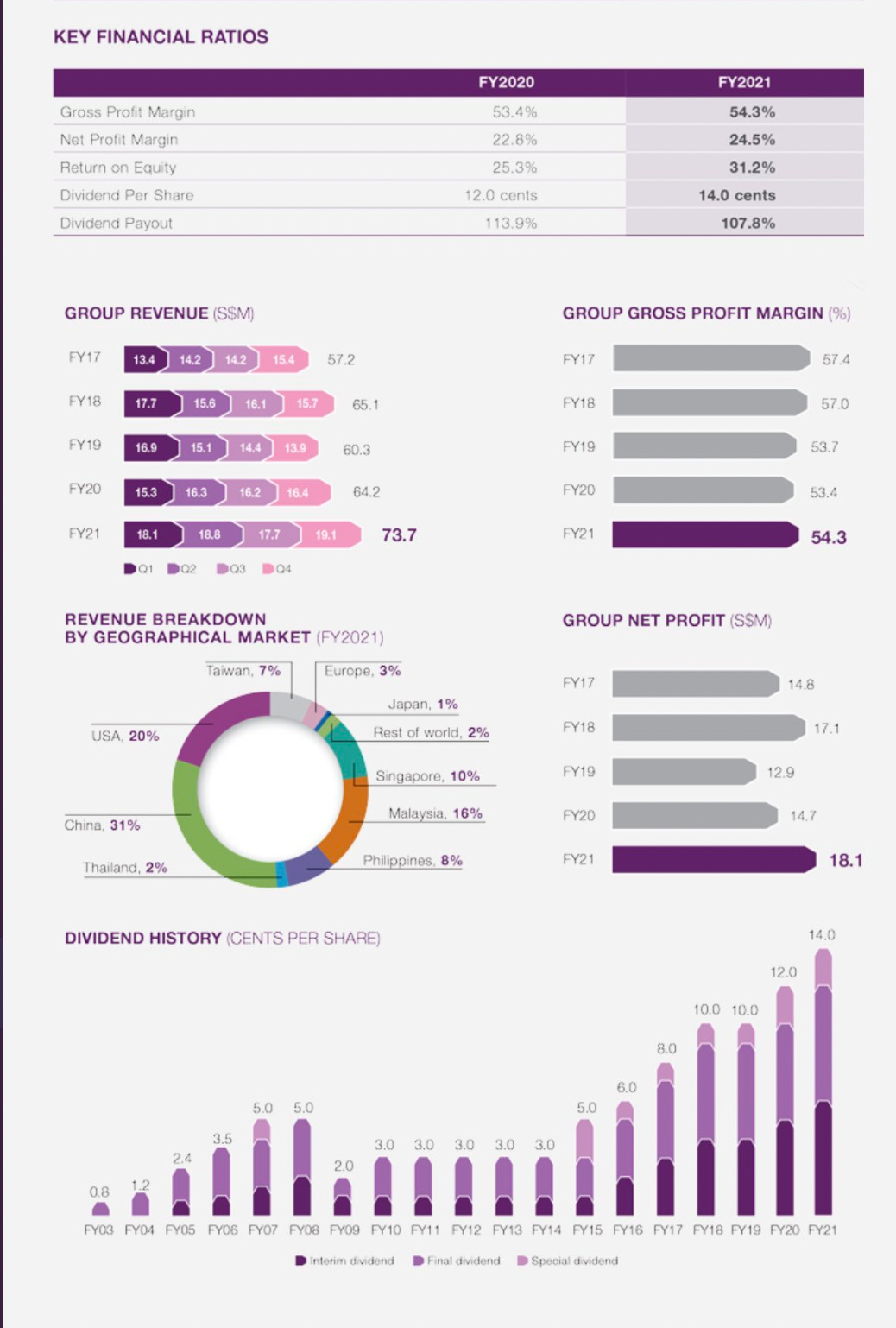

Dividends has been steadily increasing, with the exception of the years following the financial crisis in 2008. Group revenue has been increasing, with a slight blip from FY18 to FY19.

5-Year Return

5 Year Return of S&P 500 ETF (SPY): +68.66%

5-Year Return of Parkway Life REIT (C2PU): +151.03%

Conclusion

Singapore stocks have often been criticised for their lack of returns. While this might be partially true, there’re a small segment of stocks that can out-perform the US market. You just need to look hard enough to find these gems.