There was an article published in the Straits Times last week claiming that it takes 32.3 years to reach financial abundance.

The consensus on the internet seems to disagree with this, saying that this only applies to high income earners.

Others claimed that these were that people who came from inheritance money.

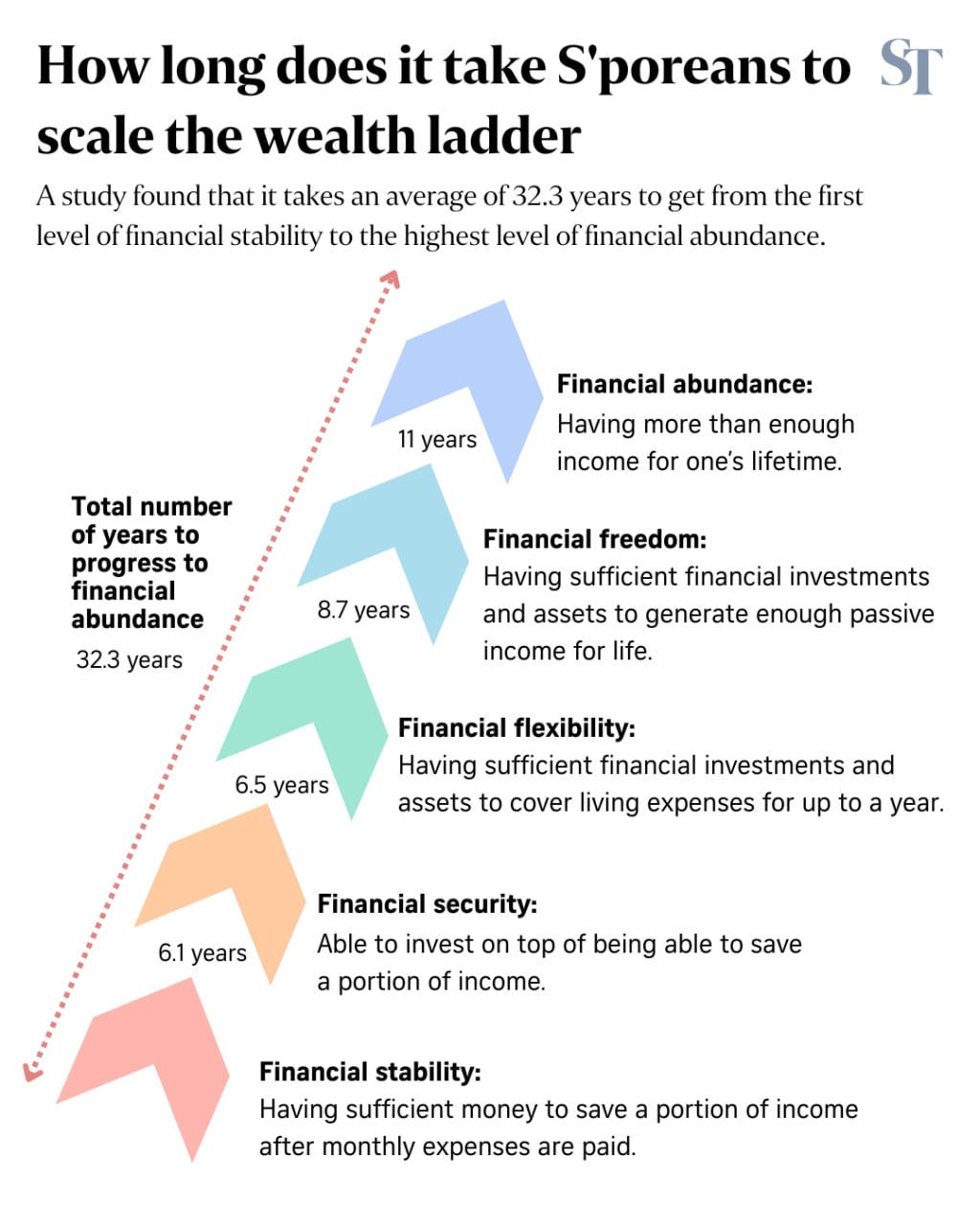

The wealth ladder

Year 0: Financial stability

Having the ability to save a portion of your income after expenses

6.1 years later: Financial security

Having money to invest on top of saving.

6.5 years later (cumulatively 12.6 years): Financial flexibility

Having sufficient financial investments and assets to cover living expenses for up to 1 year.

8.7 years later (cumulatively 21.3 years): Financial freedom

Having enough investments and assets to generate enough passive income FOR LIFE.

11 years later (cumulatively 32.3 years): Financial abundance

Having more than enough income for LIFE.

What people are saying about it

I’ve been seeing some comments making its rounds on social media so just thought I’d give my take on it.

Here’s one of the most common ones:

The survey was “not representative” of the average Singaporean. It’s only targeted towards the “high income” folks.

The key word here is household income. The more members in a household there are, the easier it is to reach the threshold.

The median household income for Singaporeans in 2022 was $10,099 per month (or >$120k per year)

Even the lower end of the income range of $70k is just slightly under the median household income.

From this, it appears that it covers most individuals, and not just the wealthy.

Adding figures to words

Adding figures to words is like putting a face to a name.

I started a new job in the height of the Covid pandemic, fully WFH. It led to me feeling disconnected with my colleagues as I was unable to put a face to a name.

The same situation applies here.

Numbers will give us a gauge of which stage of the wealth ladder we’re at.

Of course, these numbers are different for you and me.

What are my numbers?

I’d like to share what figures are comfortable for me as a single, unmarried individual.

Financial Security: At least 6 months of emergency funds, and starting to build an investment portfolio.

Financial Flexibility: Emergency funds able to last at least 12 months, possibly supplemented by some passive income.

Financial Freedom: $1m — $5m

Financial Abundance: $5m and above.

After about 5 to 6 years working in a 9-to-5, I sit somewhere in between financial security and financial flexibility.

I no longer strive to achieve FIRE.

Rather, my focus is on doing things I am remotely interested in and generating cash flow from these activities.

The journey should just be as enjoyable as the destination (if not what’s the point).

Most people will not achieve financial abundance.

While it’s a good goal to aim towards, it’s more optimal to focus your effort on generating cash flow from your daily activities.

Cash flow is like water flowing from a tap. As long as you have continuous supply of it, you’ll not die of thirst.

Ultimately, the wealth ladder is just one of many personal finance models out there. It’s by no means a hard and fast rule you should follow.