9 Of the Most Powerful Investing and Life Lessons From Warren Buffett's Annual Shareholders Letter 2021

Take Advice From Your Elders.

Warren Buffett released his annual letter to Berkshire Hathaway shareholders. His letter imparted both life and investing wisdom in equal measure.

Here’s 9 of my biggest takeaways from the letter written by the Oracle of Omaha

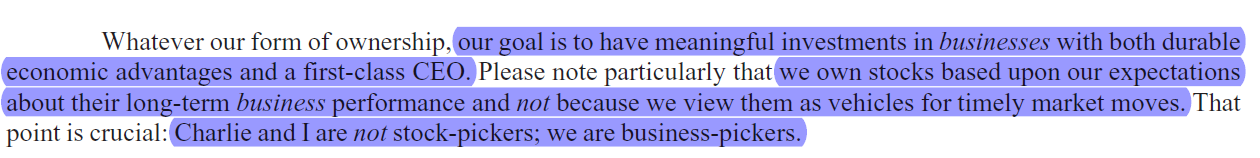

1) Berkshire’s Investment Goals

Invest in businesses with sustainable economic advantages and a world-class CEO

Be a business picker, not a stock picker

Long-Term Business Performance > Market timing

2) Warren Buffett uses leverage

One thing that might surprise some is that Warren Buffett uses leverage (aka float) in his insurance business.

Float is money that BRK holds and invests but does not belong to them.

Float has cost less than nothing

Float is very sticky

Having a low cost and sticky investing float has allowed Buffett to make long-term investments.

3) Big Wealth, Bigger Heart

Warren Buffett’s hiring of Ajit, someone with no insurance experience, shows that he is a man with a big heart.

4) Cash Position

Berkshire has pledged to hold more than $30 billion in cash and equivalents.

Warren Buffett keeps 80% of his net worth in equities

It’s important to stay invested, but always have some cash on the sidelines. This allows you to take advantage of underpriced businesses when the time comes. More importantly, holding some cash tides you through mentally during market downturns.

5) 3 ways to Increase The Value of BRK Investments

Increase earning power internally or via acquisitions

Buy non-controlling interests in good publicly traded businesses

Repurchase BRK shares

6) Don’t Overpay

As the saying goes:

“Price is what you pay, value is what you get.”

Overpaying for a business (even a good one), would be value-destroying.

7) Why Warren Buffett Enjoys Teaching

Clarity of thought

Teaching and writing forces us to put our thoughts into words. We gain clarity in our thoughts in the process.

8) Buffett’s Career Advice for University Students

Seek employment that does not feel like “work” to you, as if you had no need for money.

Granted, not everyone is in the fortunate position of doing this due to financial responsibilities and commitments. For this group of people, I’d say start something on the side. Who knows it might grow into something one day.

9) High Employee Retention

“We employ decent and talented people- no jerks. Turnover averages, perhaps, one person per year.”

The best companies to work for are the ones that are able to retain its employees.

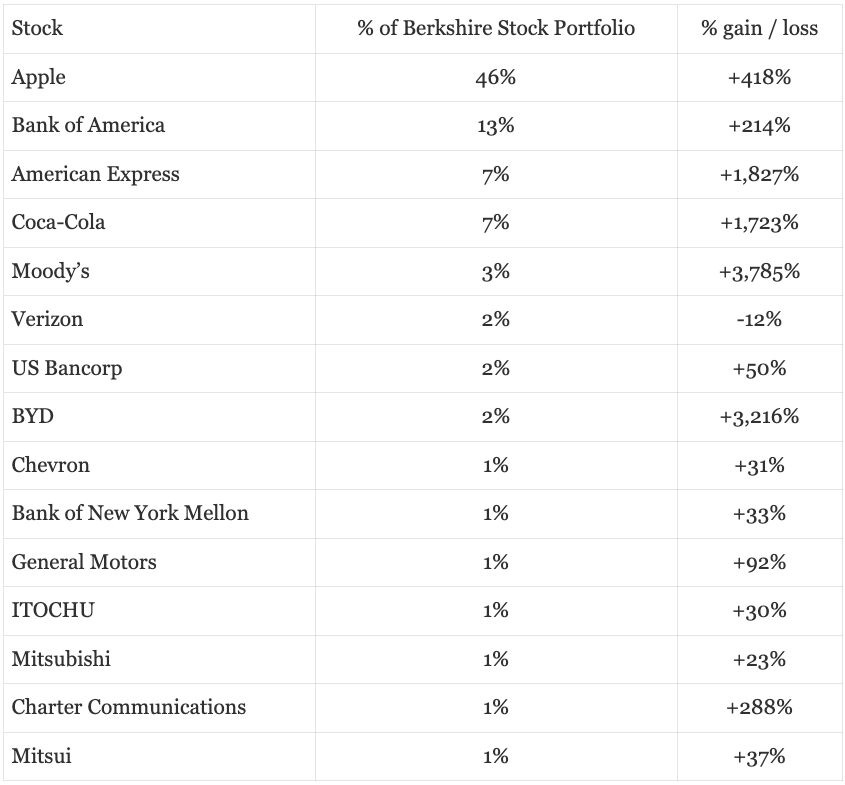

Here's What $BRK Holds in Its Investment Portfolio

It’s no surprise that Apple is still its largest holding. But the greatest total return of 3,785% came from holding shares of Moody’s.

That’s it! Let’s not forget Charlie Munger, who is Buffett’s partner-in-crime in delivering extraordinary returns for their shareholders.