Crypto scams are rampant as new crypto investors jump onto the bandwagon. Of all the crypto scams out there, the rugpull is the most common crypto scam in 2021. According to Chainanalysis, rugpulls accounted for 37% of all cryptocurrency scam revenue in 2021. Rugpulls scammed more than $2.8 billion worth of cryptocurrency from unsuspecting victims.

The Rugpull

In short, a rugpull happens when developers take investors money and run away.

The biggest rugpull in 2021 was Thodexa, a large Turkish centralized exchange. Its CEO disappeared soon after the exchange halted users’ ability to withdraw funds.

What Happens in a Rugpull?

1. Remove Liquidity

In crypto, you have liquidity pool. Liquidity pool is a collection of investor funds locked in a smart contract.

An example is the BTC-ETH pair, where we can convert from BTC to ETH and vice versa. Anyone can create a crypto and peg it to blue chip cryptos like BTC or ETH. When you want to sell, you realise that you are unable to. That’s when you know developers have disabled the ability to sell, and it’s a scam.

2. Developers Sell Their Shares

In a crypto scam, developers will try to hype up their crypto as the next big thing.

An example is the Neko Inu crypto scam. It made use of the play-to-earn gaming craze by allowing players to earn USDT.

7 Ways To Avoid Becoming a Victim of Rugpulls

1. Don’t Listen To Influencers

Crypto developers will pay influencers to talk about crypto. Influencers can get paid as much as $300k to $500k per Instagram post. Some of these influencers promote crypto projects without having a clue about what it is.

Taking the example of Kim Kardashian.

Crypto developers paid Kim Kardashian to promote the EthereumMax cryptocurrency. Investors are now suing her for her involvement in a crypto pump-and-dump scheme. Even though the names might sound similar, this crypto has no connection to Ethereum (ETH).

Here’s the price chart of EthereumMax.

Compare that with the price chart of Ethereum, and it’s self-explanatory.

2. How Does The Website Look?

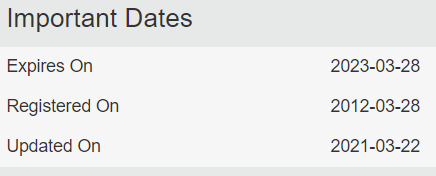

The look and feel of a website gives you an idea of whether a certain project is a scam. Having said that, this is not foolproof. Scam projects can have decent looking websites too. This is where we can check when the domain name was created and when it expires here.

It’s important to look at when the website of a certain crypto project expires. If it is expiring soon, who knows what’s going to happen after that?

3. Who Are The Developers?

Vitalik Buterin is the founder of Ethereum. Anatoly Yakovenko is the founder of Solana. These are all well known publicly available information. For some crypto projects however, the identities of the founders are not known.

Some years back, Nvidia created an algorithm website called thispersondoesnotexist.com. The site creates pictures of people that do not exist in real life. Every time you refresh the page, you get a different image of a person (try it out for yourself!).

These are computer generated pictures of people, not real people. Developers of scam cryptos can use this software to recreate images of fake people.

It’s worthwhile doing a quick google search on the founders of a crypto project. If you cannot find any publicly available information on them, chances are it’s a scam.

4. Whitepaper

An example is Bitcoin’s white paper, which tells you all you need to know about Bitcoin.

The white paper should tell us how the crypto works, what its utility is, and who’s the team behind it.

5. Does It Stink?

Just like how dogs use their keen sense of smell to sniff out for criminals, so can we with crypto. We can conduct a smell test using Token Sniffer, to determine how smelly the crypto is. The lower the rating, the smellier the crypto is.

The website is is updated in real time, so don’t worry about information becoming outdated.

Token Sniffer gives TOAST a rating of 0/100. There is a high chance that this crypto is a scam.

It’s worth noting that this site is not 100% foolproof. Use this in combination with the others and not as a standalone criteria.

6. How Much Do The Top Hodlers Have?

According to Coincarp, the top 100 holders collectively hold close to 40% of Ethereum (ETH).

Contrast this with ShibaInu (SHIB), where the top 100 holders own 80% of the crypto. If the top holders decide to sell their crypto, the crypto price will crash. This does not necessarily mean that ShibaInu (SHIB) is a scam. But it’s something to be aware of.

7. Liquidity

Check if liquidity is high

We can check the liquidity of our crypto using dex guru.

ETH has very high liquidity of $3.71B.

Compare this with Ninja Floki (NJF), which only has a liquidity of $60k.

Check if liquidity is locked and for how long

The longer the liquidity is locked, the better. We can use token sniffer to check.

Taking TRUEBURN as an example, the liquidity of this crypto will be unlocked on 16 May 2022, which is too soon.

With higher liquidity and a longer locking period, the chances of a rugpull happening are greatly reduced.

Conclusion

The crypto space is moving at breakneck speed. I’m sure there’ll be many legit looking projects which turn out to be scams in the future. To avoid becoming a victim of a scam, do these checks before investing in any crypto project.

Share this to help people avoid falling for crypto scams.