Most people fail to get started with investing because of information overload.

The amount of FOMO and FUD in the markets can get a little overwhelming at times.

The best way to overcome this fear is to construct a set and forget portfolio, while fully automating the buying process.

Diversification is a hedge against ignorance. Some people love it, some don’t.

But you don’t need 10 stocks to be sufficiently diversified.

You just need 3.

How does a 3-stock portfolio work?

1️⃣ Low-cost index fund ETFs

International

Emerging markets

S&P500

E.g. VOO, VWO, VT

2️⃣ High-quality consumer staples

Mature industries

Long history of growing dividends

E.g. COST, WMT

3️⃣ Stocks with high upside

AI

EVs

E.g. TSLA, PLTR

Borrowing the 50–30–20 Budgeting Rule

The 50–30–20 allocation is a budgeting technique commonly used in personal finance.

50% goes to needs, 30% wants, and 20% savings.

Likewise, we can do the same for our investments.

50% goes to a low-cost index fund (e.g. VOO), 30% to high quality consumer staples (e.g. COST), and the remainder to high growth (e.g. TSLA).

Let’s explore a sample portfolio with 3 stocks:

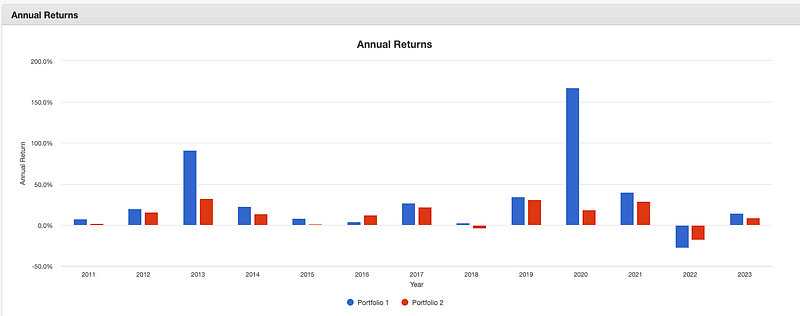

This portfolio has beaten the market 10 times in the last 12 years (from 2011 to 2022).

The best year returned a positive 168%, while the worst year had a negative return of 28%.

If that’s something you can accept, then consider playing around in portfolio visualizer to construct your own personal portfolio.

Watch out for this when designing your personal portfolio

The maximum drawdown must be within your risk tolerance.

If you think you’ll panic and sell when faced with the maximum drawdown, then that portfolio is not for you.

Choose one that does.